Lavazza, Illy, Jacob Douwe Egberts, Nespresso… Many coffee brands can be found in the Dutch on-trade market. But which brands dominate the market in terms of market distribution? What type of coffee is most commonly served? And what are the provincial differences of brand distributions?

In this article, we’ll look into the most popular coffee brands in the Netherlands in the Bar/Café segment.

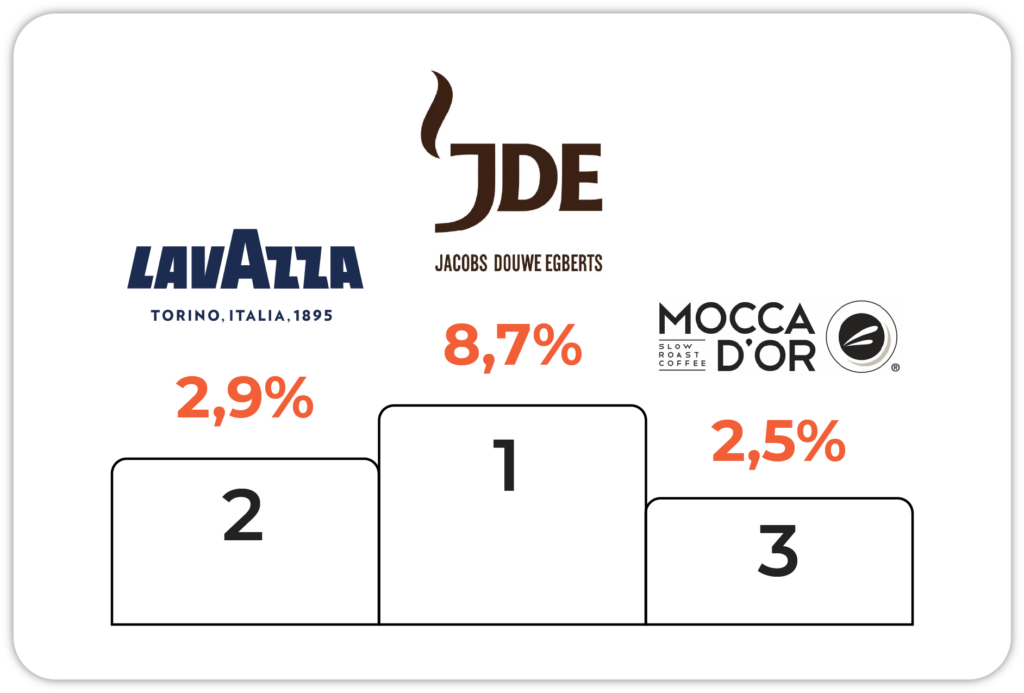

Which are the top 3 coffee brands in the Netherlands?

If we look at the coffee brands most commonly served in the Bar/Café segment, Jacob Douwe Egberts arrives first with 8.7% of the total market distribution. The Dutch company offers a diverse portfolio of brands (including Douwe Egberts, Kenco or L’Or) and is by far the most popular in the Netherlands. Second place goes to the Italian brand Lavazza with 2.9% of the total market distribution, followed closely by Mocca d’Or with 2.5%.

Coffee brand preferences according to the province

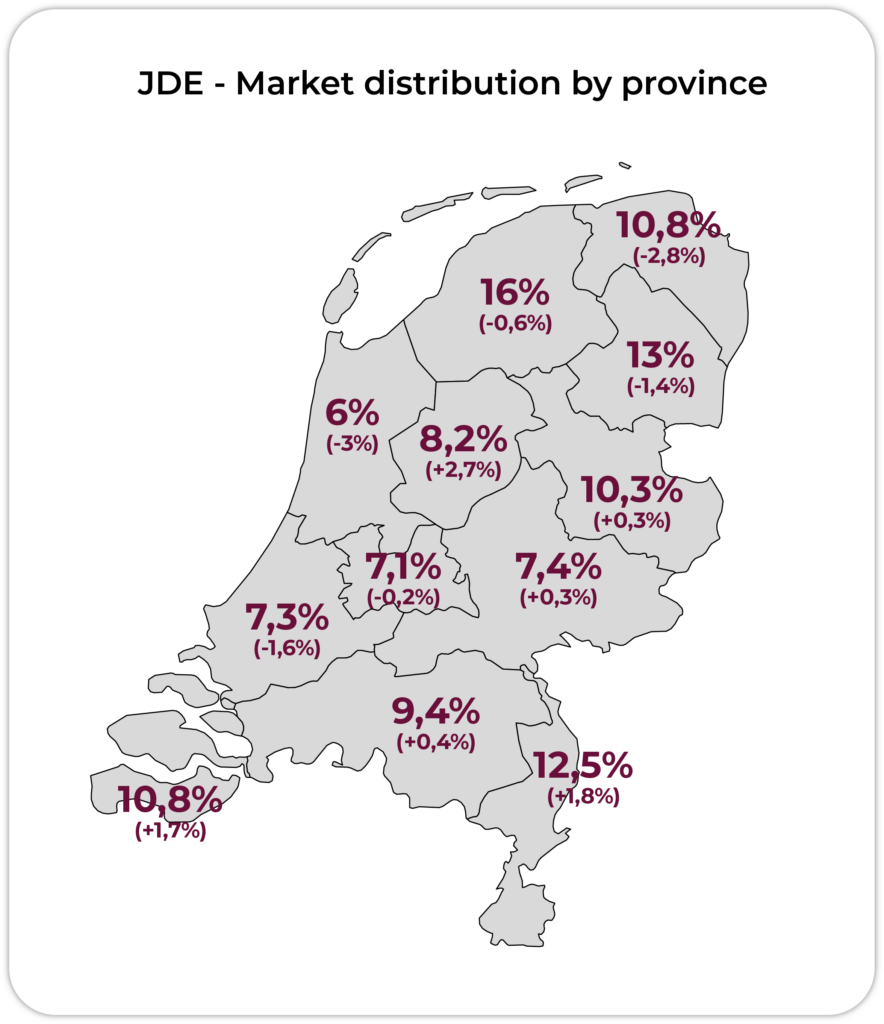

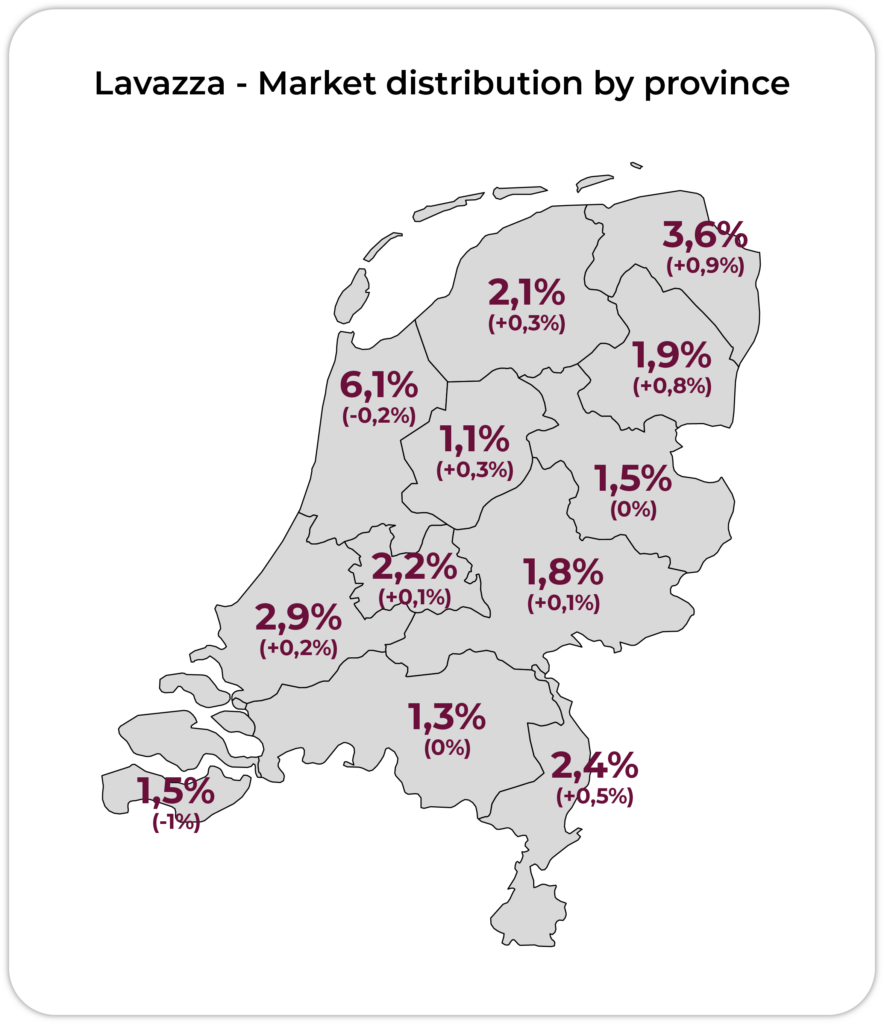

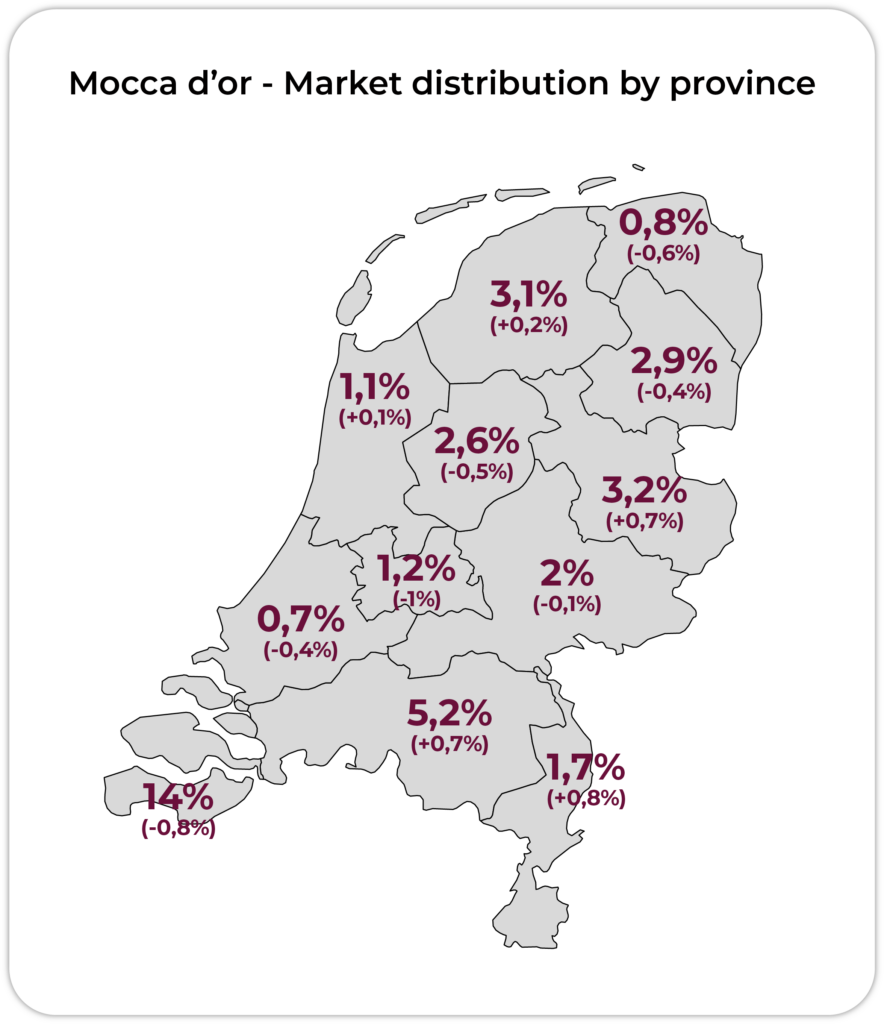

Despite the national top three, we also see differences among these brands in their market distribution at the regional level.

JDE is strongly established in every province, especially in Friesland (16%), Drenthe (13%), and Limburg (12.5%). However, in Friesland and Drenthe, we can see that their market share is declining compared to last year by -0.6% and -1.4%. Overall, we can see that the market distribution of JDE is slightly decreasing in the Netherlands with an average drop of -2.4% across the whole territory, the highest drop being in Noord-Holland with -3%.

The decline of JDE seems to benefit other brands, including Lavazza. Indeed, its market distribution increased by +2% on average in the Netherlands. If we go back to the example of Friesland and Drenthe, we can see an increase for Lavazza of +0.3% and +0.8%, respectively. It is too early to speak of a shift between the market leaders of coffee brands, but it is a notable one.

The market distribution of Mocca d’Or is also really interesting. While the percentage of market distribution in most regions fluctuates between 1% and 3%, this percentage rises to 14% in Zeeland (which is 3.2% more than JDE), showing very marked trends depending on the region.

What about coffee types?

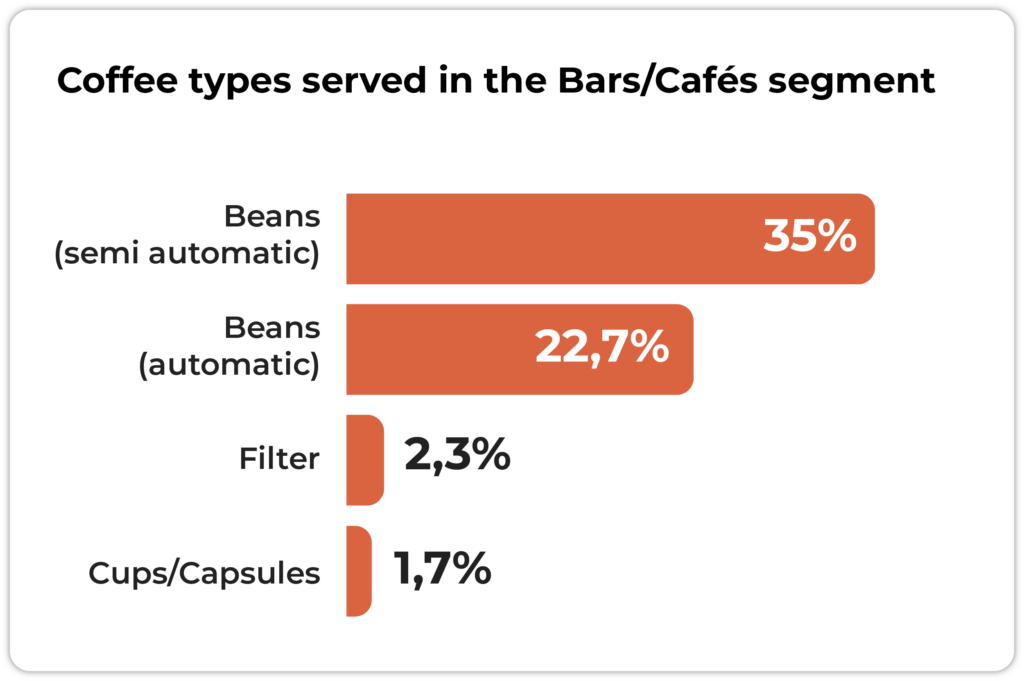

Regarding coffee types served in the Bar/Café segment, we can clearly see that fresh beans dominate the market. The market share is then divided between automatic and semi-automatic.

What’s the difference? Automatic machines handle almost every step of the coffee-making process (they grind the coffee beans, tamp the coffee, brew it, froth the milk…). Semi-automatic machines offer more control over the coffee-making process, allowing adjustments and customized coffee.

Semi-automatic beans are the most popular coffee type served in bars with 35% and is closely followed by automatic beans with 22.7%.

Roamler newsletter

Get the latest insights, innovations, and opportunities when it comes to efficiency for your business.

Conclusion

While JDE remains the market leader, its market distribution has shown signs of a slight decline. This shift presents opportunities for other brands such as Lavazza, which is gradually gaining ground. Understanding the dynamics of the Dutch coffee market is crucial to respond strategically with your brand and ensure growth.

Do you also want insight into these coffee market figures and, like other brands, be able to quickly respond to new insights and trends? Then fill in your details below and we will get in touch!