The term “Horeca” is an abbreviation derived from the initial letters of these three segments: HOtels, REstaurants, and CAfés. It’s an important market segment for FMCG companies, as these establishments often require large volumes of consumer goods such as food, beverages, cleaning products etc.

In this article, we will have a market overview of the Horeca sector between November 2023 to April 2024.

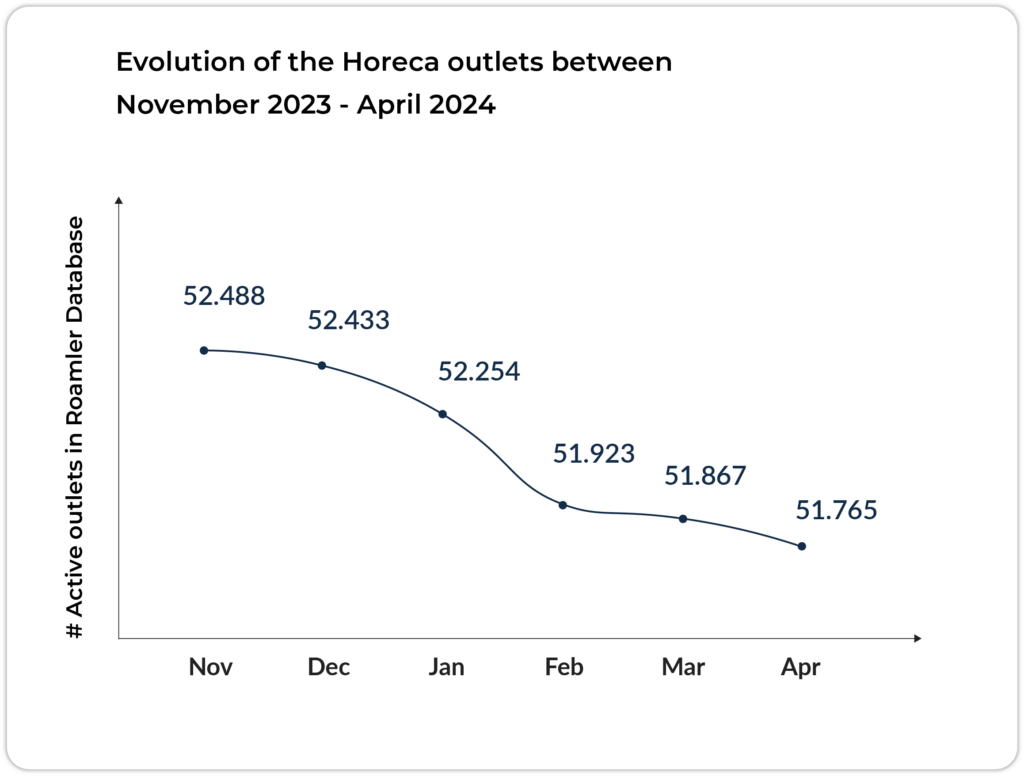

A global decline

If we look at the total number of active outlets in the Horeca sector between November 2023 to April 2024, we see a clear decline of 1,4%. Several reasons can explain this decrease like the economic situation (consumer tend to cut back on non-necessary expenses), increasing competition but also regulatory change with for example the repayment of the Covid-loans, with a deadline in February.

Which segment is the most impacted?

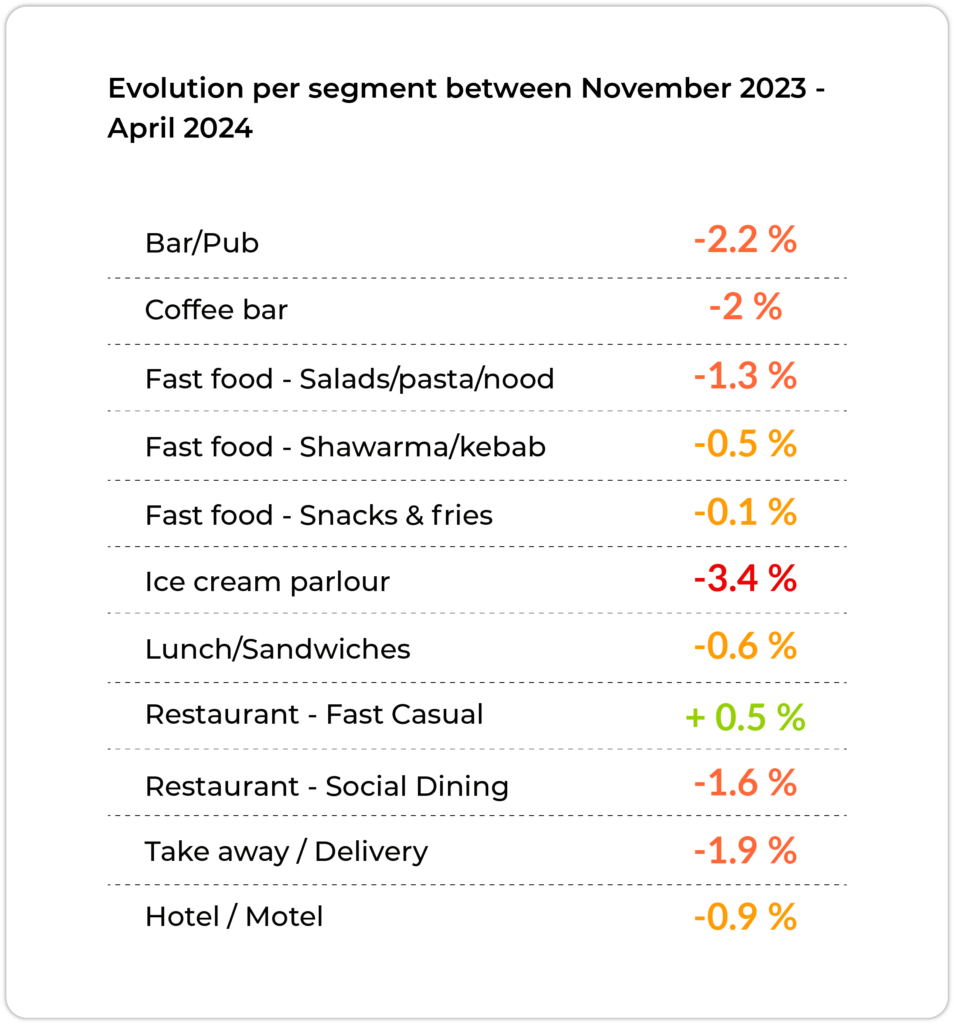

We saw that the total number of outlets in the Horeca sector is declining, but which segment is the most impacted? Are there any segments still growing? In this table, you will find the evolution per segment between November 2023 to April 2024.

We clearly see that some segments are experiencing some difficulties: Bar/Pub, Coffee bar and Take away/Delivery are all experiencing a drop of around 2%. We see also see a decrease of 3,4% for Ice cream parlour but these type of outlets are generally less active during winter months and we should wait for summer before drawing conclusions on this segment.

Despite the overall slowdown, we still see some growth for Fast Casual Restaurants (+ 0.5 %). In our previous articles, we already saw that Fast Casual Restaurants was one of the most dynamic and resilient segment.

Roamler newsletter

Get the latest insights, innovations, and opportunities when it comes to efficiency for your business.

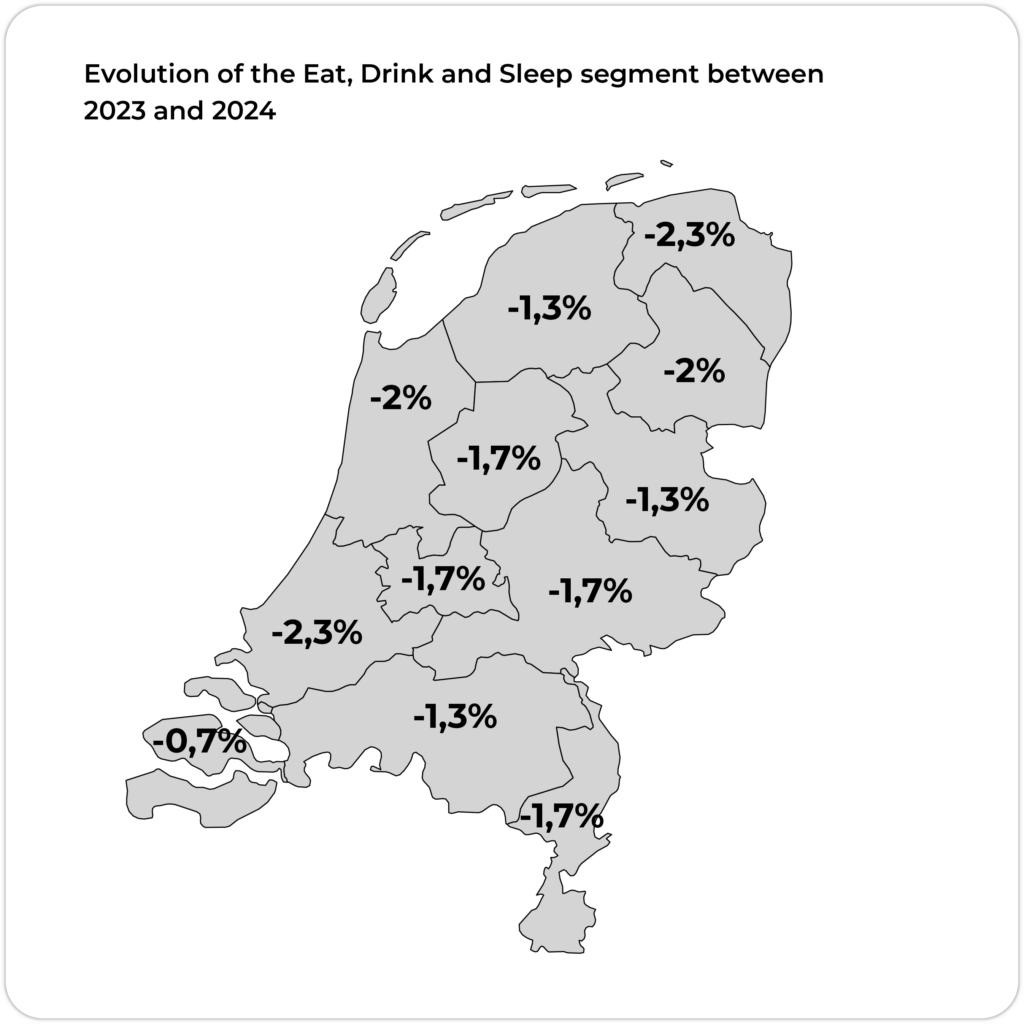

Comparison per province

If we look at the overall trend, we see a decline of the Eat, Drink and Sleep sector in all provinces, especially in Zuid Holland and Groningen (-2,3%). Zeeland is the less impacted province with a slight decrease of 0,7%.

If we look at the bigger picture and compare these numbers with the average active outlets in 2023, we clearly see that the most impacted segment in Social Dining Restaurants. Indeed, there are 208 fewer outlets than last year. Bar/Café also shows a decline comparing to 2023 with -109 active outlets.

In contrast, Fast Casual restaurants still shows a slight increase with +30 active outlets compared to last year.

Conclusion

The Horeca sector has experienced a notable decline in the past six months. While segments like Bar/Pub, Coffee bar and Take away/Delivery have been heavily impacted, others like Fast Casual Restaurants have shown resilience with slight growth. Provincial disparities highlight varying trends across regions, emphasizing the importance of localized strategies.

Access to up-to-date market data is crucial for businesses operating in the Horeca sector to navigate challenges and capitalize on opportunities effectively. With our Location Database, you can obtain key location information among 30+ features. In this way, you can execute your strategy perfectly and avoid sending sales representatives to closed or incorrect locations.