Over the years, bakeries and coffee bars have evolved significantly to adapt to changing consumer preferences and lifestyles. Let’s delve into the data to understand the current landscape and evolution of these establishments in the Netherlands.

The Evolution of Bakeries in the Netherlands

The Netherlands counts over 3700 bakeries. What’s particularly noteworthy is the increasing digital footprint of these establishments, with 70% now maintaining an online presence, a trend observed over the past six months. This shift towards digitalization has enabled bakeries to reach a wider customer base and enhance customer experience through services like online ordering and reviews.

Interestingly, almost 30% of bakeries with an online presence now offer delivery services, making it more convenient for customers to enjoy freshly baked goods from home. This evolution reflects a strategic response to changing consumer behaviors, particularly in light of the COVID-19 pandemic, which accelerated the adoption of online shopping and delivery services across various industries.

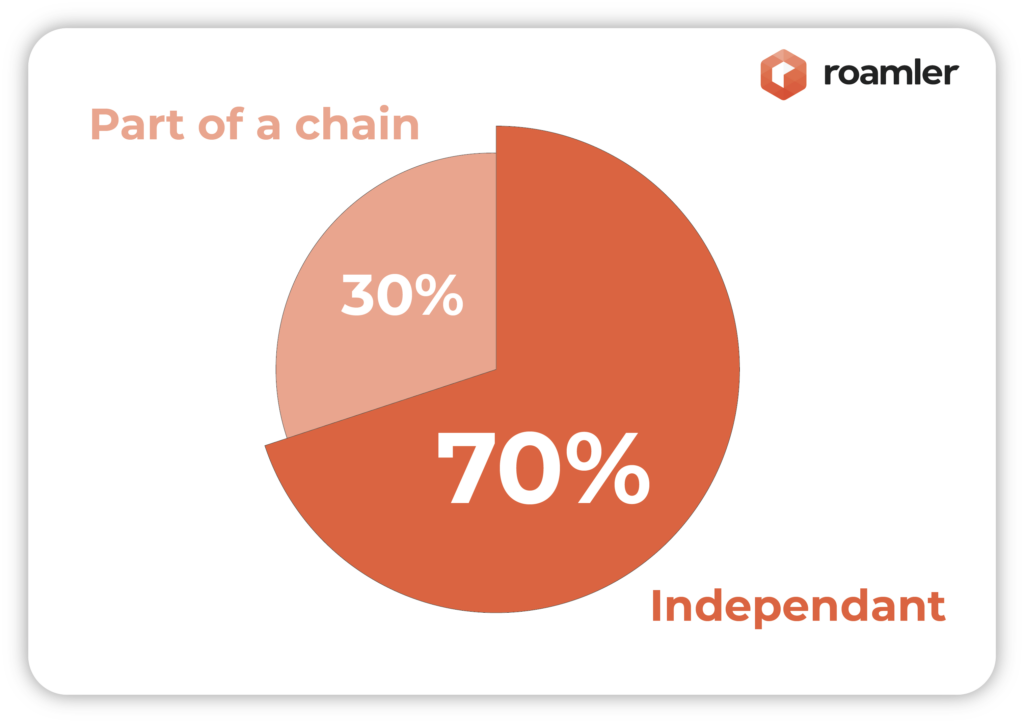

While a significant portion of bakeries remains independent entities, approximately 30% are part of large chains.

When we look at the type of coffee type used in bakeries, beans keeps on growing and are capturing a substantial 57.4% share of the market. This represents an increase of 5% points, signaling a clear preference among consumers for freshly ground coffee beans over the convenience of pads, cups, or capsules.

The Evolution of Coffee Bars in the Netherlands

The Netherlands counts over 1400 coffee bars with an even higher online presence than bakeries: 75% of these establishments are leveraging digital platforms to engage with customers and enhance service offerings. However, we are seeing a weaker trend for delivery, with only 250 coffee bars offering this service. It is also important to note that 50% of coffee bars has a terrace.

When we look at the type of coffee type used in coffee bars, beans logically remain the biggest segment with a 91.8% share of the market. However, despite their dominance, beans have experienced a slight decline of 1% point. This shift suggests a nuanced landscape where consumers may be exploring alternative coffee options On the other hand, the filter and fresh-brew segment within coffee bars is experiencing notable growth, capturing nearly 5% of the market share (+0.6%).

How social media impact Bakeries and Coffee Bars traffic?

We have recently found that new social media platforms like TikTok have a big influence on the popularity of coffee bars and bakeries. People are willing to wait in line for up to 20 minutes for a delicious croissant, cruffin, or cookie. This is particularly noticeable in large cities where massive queues form outside these outlets.

These locations are going viral on social media and stand out in the Roamler location database with a high rating in Online Consumer Activity. This is a convenient way to get an overview of today’s most relevant coffee bars and bakeries!

Conclusion

The evolution of bakeries and coffee bars in the Netherlands underscores a dynamic interplay between tradition and innovation, local and global trends. From digital technologies to new service offerings, these establishments continue to adapt to changing consumer demands while preserving the timeless allure of freshly baked goods and artisanal coffee.