The hospitality market in Europe faced several challenges in 2023. But what does 2024 so far hold? Are certain segments thriving while other struggle? And how do different European countries compare?

In this article, we analyze the overall situation and performance of some key segments (Fast Casual restaurants, Social Dining restaurants, Bars/Cafés, and Coffee Bars) across five European markets: The Netherlands, Belgium, Germany, France, and the UK.

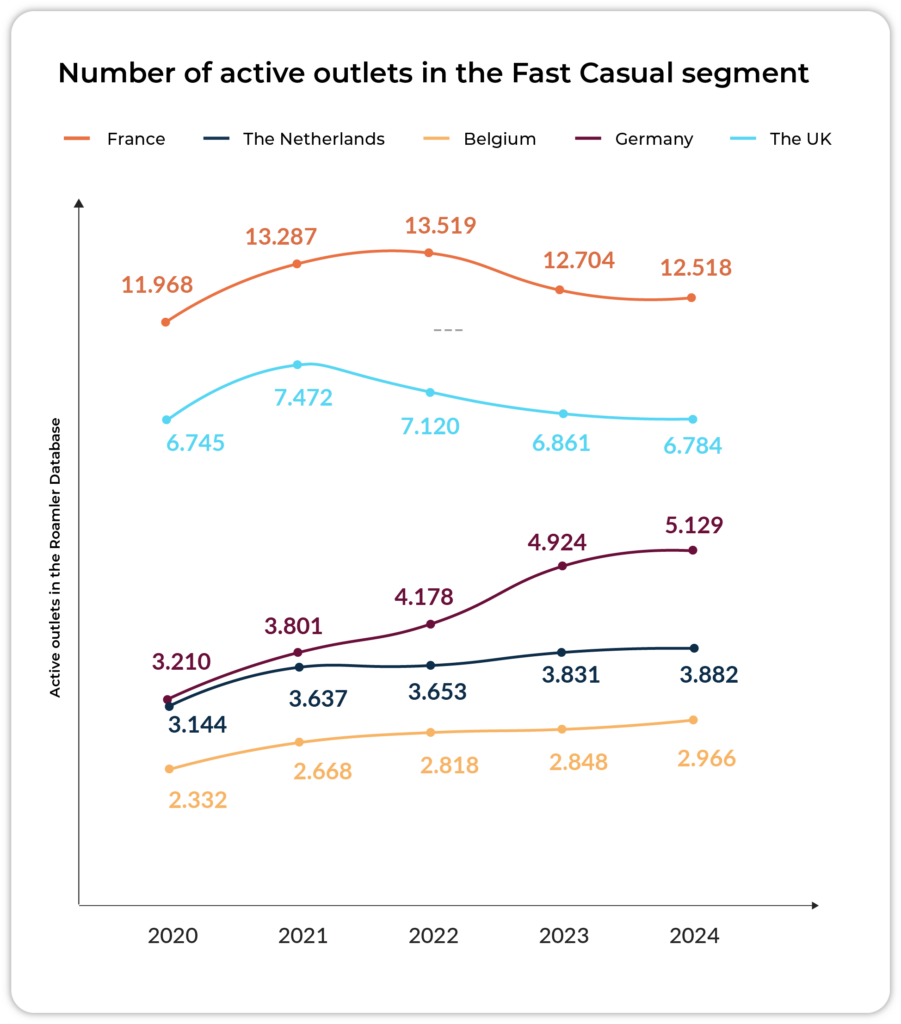

Fast Casual Restaurants

The Fast Casual segment has shown resilience across most European markets, though with varying degrees of growth and decline.

For example in the Netherlands, the Fast Casual segment saw its number of locations going up by 1% compared to 2023. In a previous article, we saw that Fast Casual restaurants were pretty resilient and have have been growing even though most of the other eat/drink/sleep segments were declining in the Netherlands. However, this growth should be monitored closely, as we see signs of slowdown (+5% in 2023 VS +1% in 2024).

In Belgium and Germany, Fast Casual restaurants are also showing resilience to the challenges of the market as they both see a 4% increase in 2024 in this segment.

On the other hand, France and the UK experience a decline in Fast Casual restaurants with a 1% drop for both countries in 2024. However, the decline tends to slow down comparing to 2023 where we saw much higher drops (-6% for France and -4% for the UK), suggesting a potential stabilization.

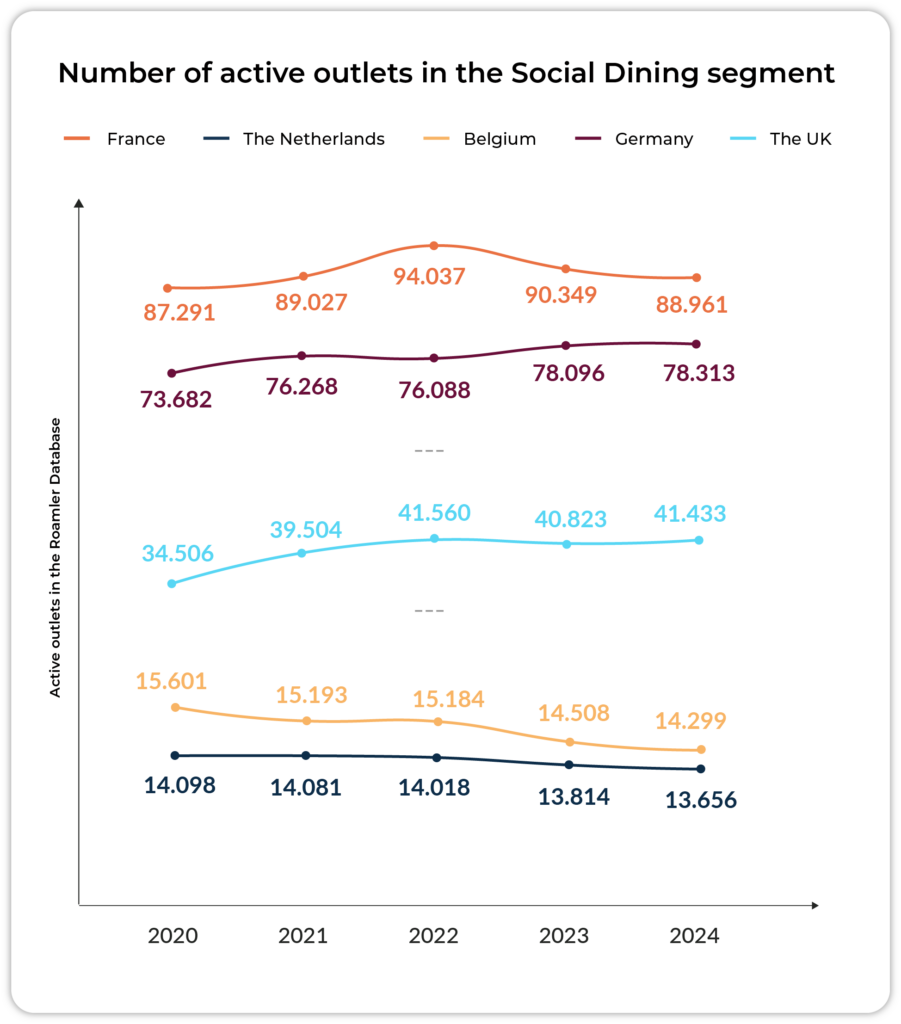

Social Dining Restaurants

The Social Dining segment presents a mixed picture across different countries.

In the Netherlands, the Social Dining segment showed a notable decline, with a 1% drop compared to 2023. This segment is stagnating since 2020 and declining since 2023 due to many closures in the market (not bankruptcy).

Belgium’s Social Dining segment also experienced a 1% decline. However, following a challenging 2021 with a 3% drop and a 4% decrease in 2023, the rate of decline appears to be slowing.

In France, this segment was performing really well the past years with a 2% growth in 2021 and 6% growth in 2022. However, since 2023, the segment has shown signs of struggling, with a combined 6% drop over 2023 and 2024.

However, we see an increase in the number of locations for Social Dining restaurants in Germany and the UK. In Germany, the increase appears to be fragile, with only a few hundred more locations than in 2023 (0%). In the UK, the 1% growth in 2024 is really encouraging for the Social Dining segment which had a complicated year in 2023 (-2%).

Roamler newsletter

Get the latest insights, innovations, and opportunities when it comes to efficiency for your business.

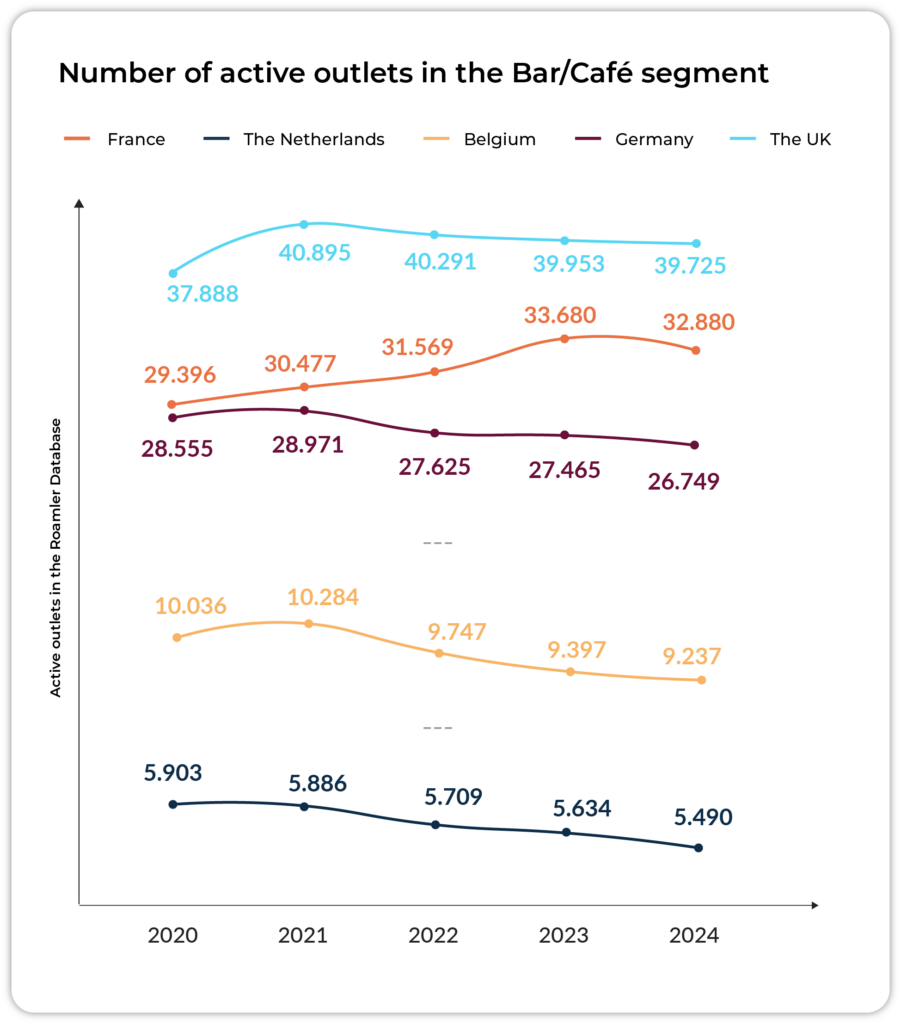

Bars/Cafés

The Bars/Cafés segments is struggling as we see a decline in every country analyzed.

The Netherlands and Germany both see a 3% drop in this segment. France and the UK also saw a decline in the number of locations with respectively -2% and -1%.

However, the results are promising in Belgium: after two complicated years in 2022 (-5%) and in 2023 (-4%), the decline seems to slow down with only a drop of 2% in 2024.

Coffee Bars

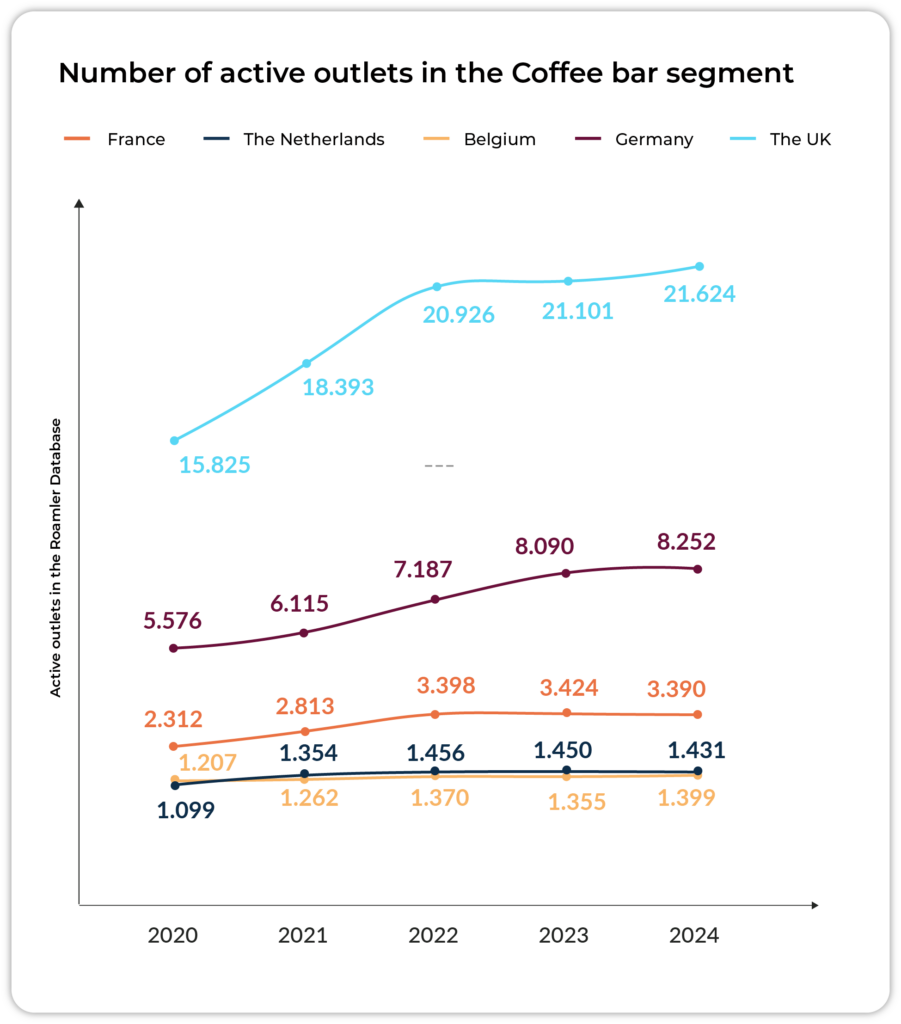

Coffee Bars have shown varying trends across different countries.

France and the Netherlands show a similar pattern. In both countries, the Coffee bar segment saw significant growth over the past year and started to decline in 2024 (-1% for both countries). Did the coffee bar segment become saturated? This segment requires close monitoring in the coming months.

Germany and the UK also show signs of slowdown in this segment. Even though both countries experience a 2% increase in 2024, this growth is not as significant as in previous years. For instance, Germany saw an 18% increase in this segment in 2022.

Conclusion

The hospitality sector in Europe continues to show a mixed recovery in 2024. Some segments, like Bars and Cafés, are struggling and declining in all the analyzed countries. However, other segments are showing promise. The Fast Casual segment is driving growth in the Netherlands, Belgium, and Germany, while Social Dining is expanding in the UK.

Access to up-to-date market data is crucial for businesses operating in the hospitality sector to navigate challenges and capitalize on opportunities effectively. With our Location Database, you can obtain key location information among 30+ features. In this way, you can execute your strategy perfectly and avoid sending sales representatives to closed or incorrect locations.