According to research, in 2018 the sales of meat alternatives have increased by 30% compared to the previous year. This trend is a clear signal of the rising awareness among consumers about meat consumption, due to health, environment and animal related reasons.

To learn more about how and why consumers are slowly moving towards a meatless lifestyle, we asked our community of mobile users to tell us about their consumption of meat alternatives.

Find out more about preferred brands, consumption routines and average spend in our Meat Substitutes Consumer Report.

MEAT SUBSTITUTES: NOT ONLY FOR VEGETARIANS

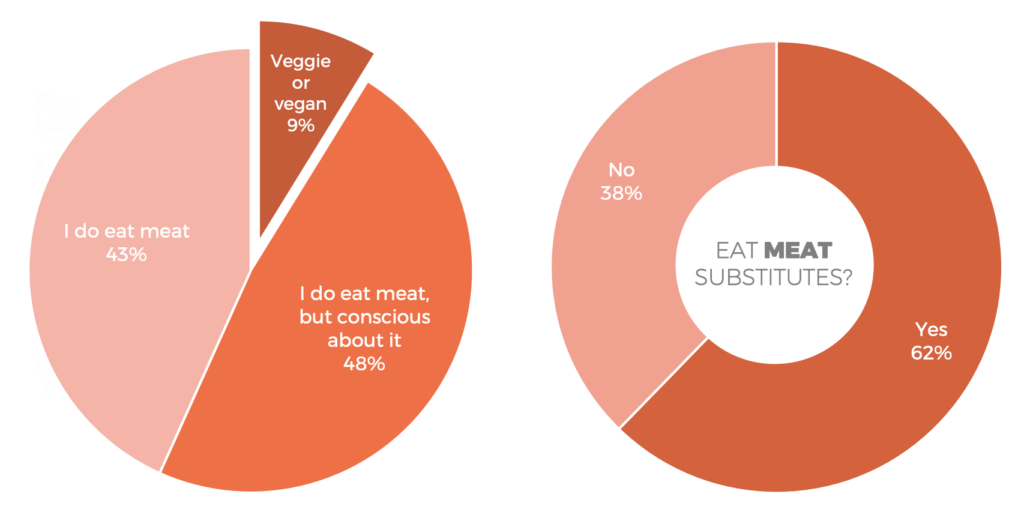

Even though only an average of 9% of respondents claims to be vegetarian or vegan, an impressive amount of 62% of Europeans eats meat substitutes. The plant-based alternatives are very popular especially in the UK (71%) and Germany (73%).

THE MOST COMMON REASONS TO CONSUME

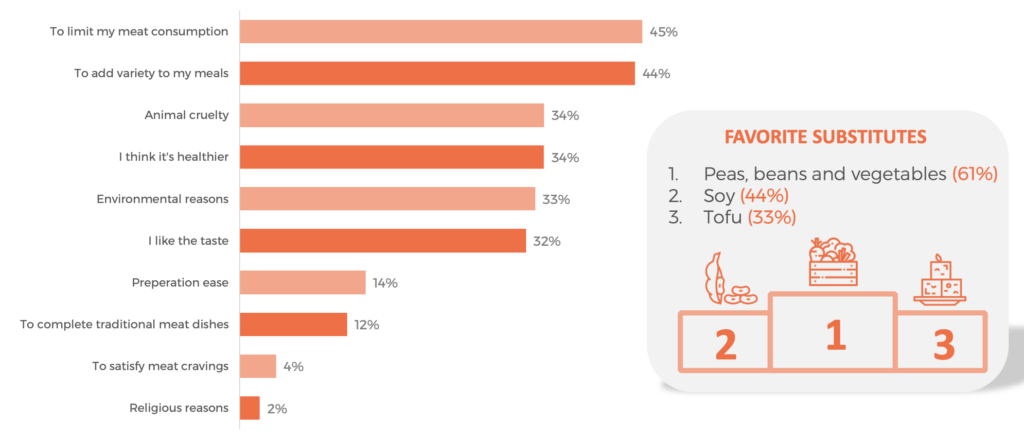

Most consumers opt for meat-substitutes to add variety to their meal-plans (44%) and to limit their overall meat consumption (45%).

QUANTITY AND OCCASION

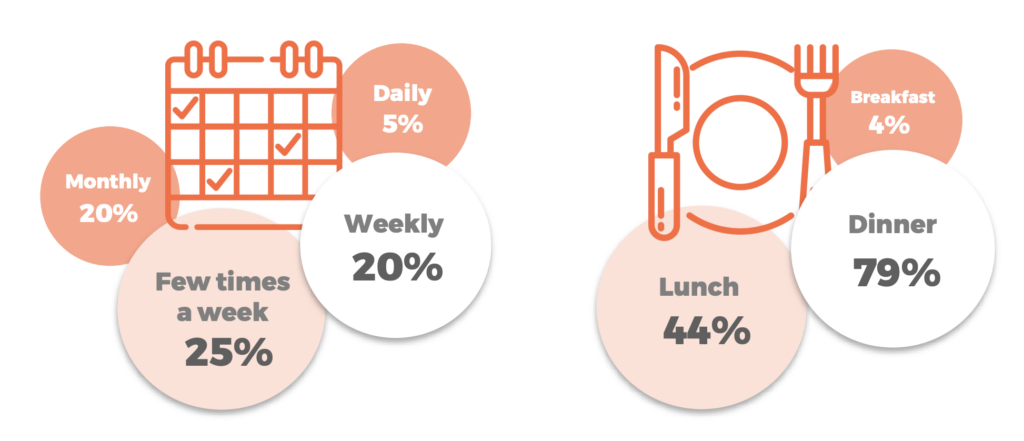

The majority of Europeans consumes meat substitutes a few times a week (25%), while only 5% of consumers eats them daily. Meat substitutes are mostly eaten during dinner (79%) and lunch (44%).

THE TOP FACTORS INFLUENCING THE PURCHASE

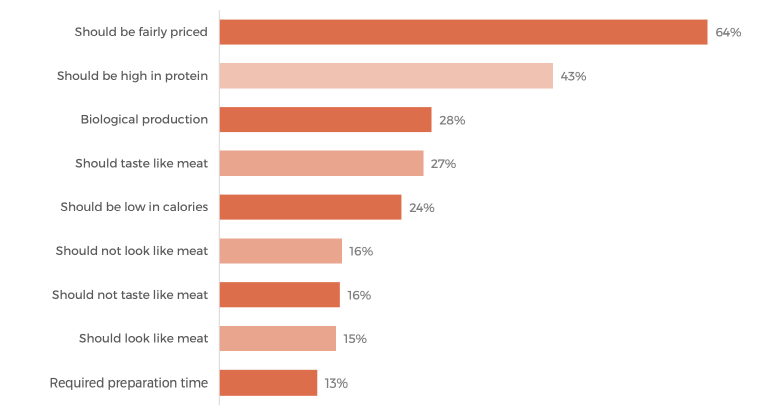

A fair price seems to be the most important factor for the majority of consumers (64%). This factor is immediately followed by a high source of protein (43%) and biological production (28%).

THE PERFECT LOOK & TASTE

…53% prefers if it looks and tastes like real meat. …47% rather eats alternatives that look and taste nothing like real meat at all.

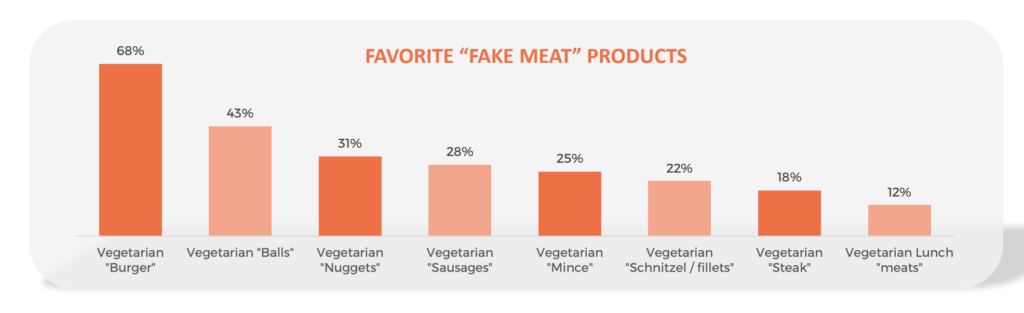

EUROPEANS NOT PICKY ABOUT BURGERS

Vegetarian burgers top the chart of favorite meat substitutes (68%), immediately followed by vegetarian “balls” (43%) and “nuggets” (31%). Compared to the European average, Brits score exceptionally high on eating vegetarian “sausages” too (68%).

On the opposite note, with only 12% of preferences, plant-based “lunch meats” are the least popular among consumers.

MEAT SUBSTITUTES TOO EXPENSIVE?

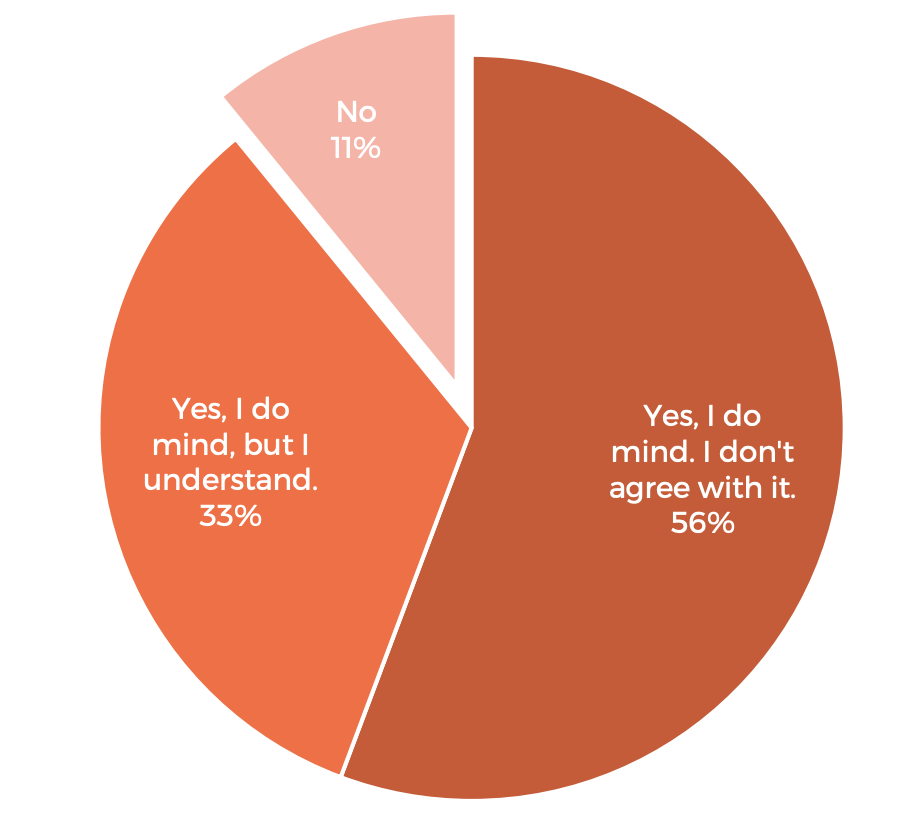

If around 11% of Europeans do not mind paying slightly more for a meat substitute, a total of 89% of consumers do state to be concerned about paying more for meat substitutes than for real meat.

HOW MUCH?

Most Europeans are willing to spend between 1 and 5 euros a week on meat substitutes.

DO PROMOTIONS INFLUENCE THE PURCHASE?

With nearly 90% of respondents stating to pay close attention to the price of the meat-alternatives they buy, promotions play an important role in the choice of both the brands and products purchased, as well as in the quantity of products bought.

WHAT ABOUT THE KIDS?

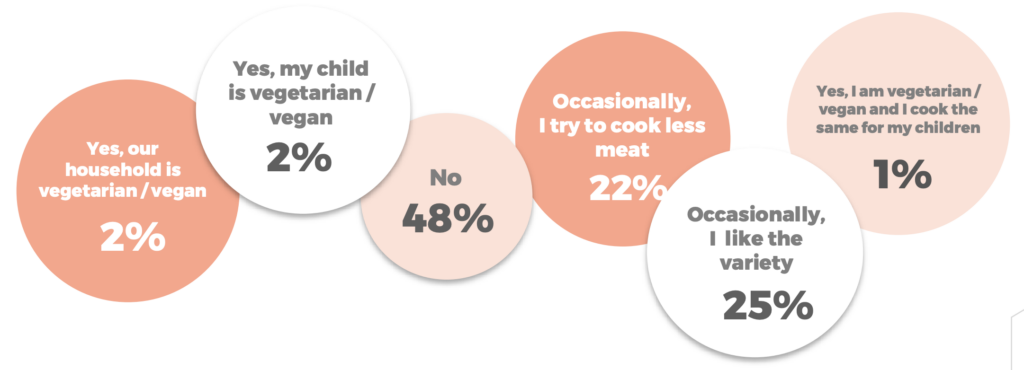

Are meat-alternatives also fed to children? Even though research shows that Generation Z is driving a global shift towards more vegetarian and vegan eating routines, we found that about nearly half of European parents (48%) never prepare meat substitutes for their children.

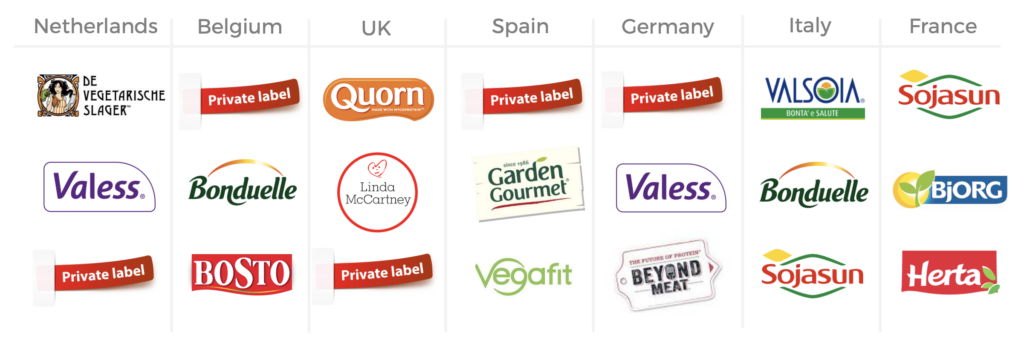

MOST POPULAR MEAT SUBSTITUTES BRANDS

The findings presented in this report are based on the results of an investigative task submitted to the Roamler Crowd during the month of september 2019. The purpose was to determine the crowd’s purchasing practices when it comes to meat substitutes. The findings take into account data collected from 6.796 respondents, located in Italy, France, Spain, UK, Belgium, The Netherlands and Germany.