So far, this year’s holiday season has had unique challenges for both consumers and retailers. Nevertheless, several researches show an expected increase in food and beverage sales during the peak season. For food and beverage brands, the question that arises is: How to attract the attention of consumers during this busy period, among the many brands on the shelves?

We asked our large community of European mobile users to tell us about their in-store preferences, reviewing merchandising holiday retail trends. Read all our interesting findings in this month’s Consumer Report.

Recap

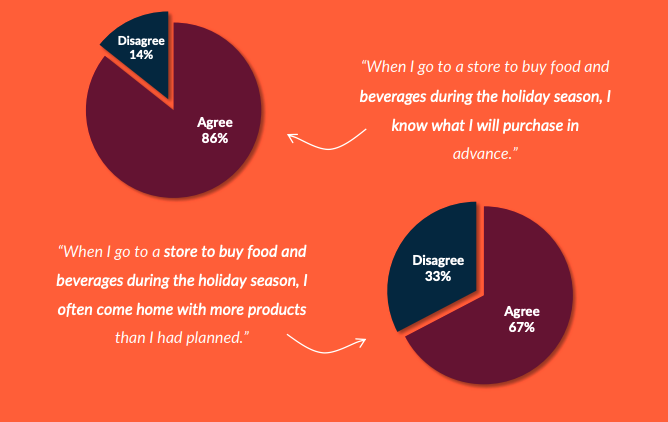

▪ Even though European consumers plan ahead, most of them still make impulse purchases when it comes to food and beverages.

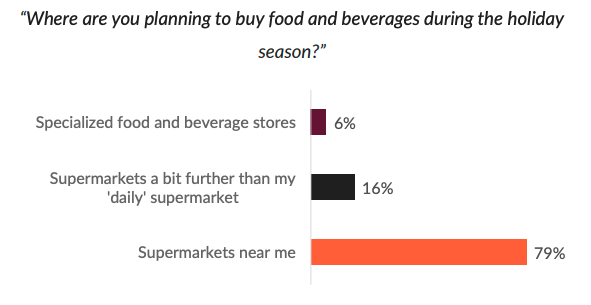

▪ Specialized food and beverage stores appear not to be very popular among Europeans.

▪ The majority of European consumers do not need a Click & Collect option when buying food and beverages.

▪ All current food and beverage product and packaging trends are generally liked and increase purchase intent.

▪ Handing out food and beverage samples in store works for both brand building goals and driving sales.

▪ Combining new channels with traditional ones is preferred by European consumers when it comes to promoting food and beverage products.

1. BUYING BEHAVIOR

Trend 1: No more impulse buying

A Salesforce research reveals a decrease in impulse buying, since consumers tend to prepare more for shopping trips due to the pandemic. This is in line with our findings, which show that the majority of Europeans (67%) plan what food and beverages they will purchase before they go to a store.

However, 86% of European consumers also indicate that they often buy more products than they had planned. To sum it up, it can be stated that, even though consumers plan ahead, most of them still make impulse purchases when it comes to food and beverages.

Trend 2: Shopping special products close to home

Other pandemic-caused trends are shopping close to home, since shopping is considered more of a necessity, and purchasing specialized food to compensate for the lack of restaurant dinners.

From our results it can be deduced that shopping close to home is indeed a trend among most Europeans, with 79% of them indicating that they intend to buy their food and beverages at supermarkets nearby during the holiday season.

Specialized food and beverage stores, on the other hand, appear not to be very popular among this

group of consumers, with only 6% indicating that they will buy food and beverages from these stores.

Trend 3: Click & Collect

According to experts, the ‘Click & Collect’ way of shopping (order online, pick up in store) is becoming more and more popular, as consumers benefit from fast service and low costs of local retailers, while avoiding shopping in crowded areas.

However, our results show that the majority of European consumers do not need a Click & Collect option

for food and beverages during the holiday season. In Germany in particular, there is little preference

for this service (14%). Click & Collect is most popular among Spanish consumers, with half of them indicating they want to use the service.

2. PRODUCT AND PACKAGING TRENDS

Trend 1: Nostalgic packaging

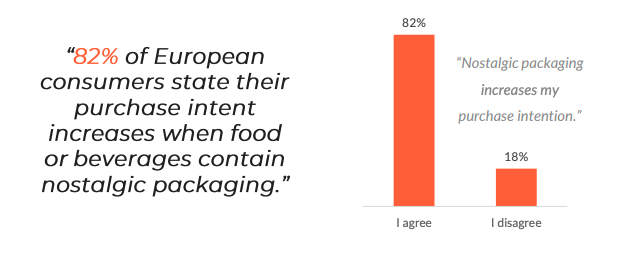

A nostalgic and craft product lookand-feel creates a sense of continuity and tradition, aligning perfectly with the holiday feeling. It makes sense that 72% of European consumers state they like it when food and beverage products contain festive packaging during the holiday season.

Since many nostalgic and vintage items are considered to be rare and precious, it can encourage consumers to purchase the product and to feel more engaged with the brand. This is supported by our results, which show an increase in purchase intent when a food or beverage product contains nostalgic packaging for 82% of European consumers.

Trend 2: Festive packaging

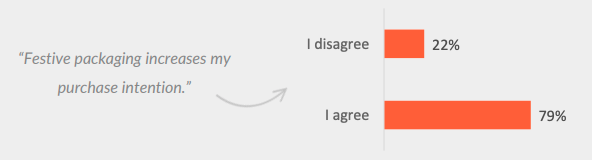

Festive seasonal packaging is, for many brands, a chance to reinforce their brand identity, by affecting consumer emotions and creating a memorable shopping experience. Additionally, festive packaging allows brands to remain consistent across channels, from ad to in-store.

Although festive packaging have been quite popular for a while, 82% of European consumers still indicate they like it when food and beverage products contain a festive packaging.

Since festive packaging has the strength to attract the loyal audience with something out of the ordinary, it is a good way to utilize impulse buying during the holiday season, and it is not surprising that 79% of

European consumers state that festive packaging increases their purchase intentions.

Trend 3: Limited holiday editions

Seasonal limited editions have the power of giving consumers a sense of urgency and relevancy, which can eventually lead to more purchases. This is reflected in our results, which show that most European consumers agree that limited food and beverage editions during the holiday season lead to a higher purchase intent (86%).

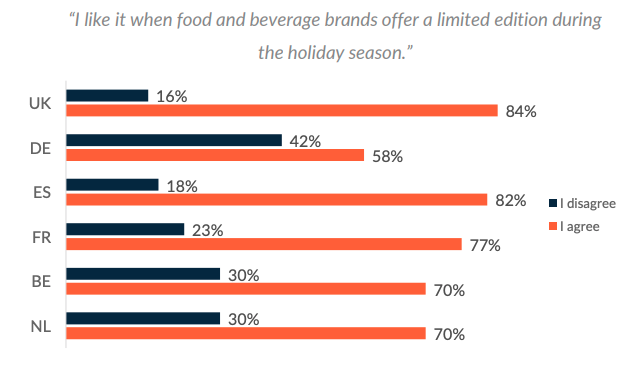

In addition to an increasing purchase intent, limited editions are generally liked by European consumers (74%). There are, however, a few slight differences between countries.

The limited edition is least appreciated in Germany (58%), while consumers in the UK and Spain seem to enjoy seeing holiday limited editions on the shelves (84%; 82%).

Trend 4: Reusable packaging

During the holiday season, a lot of food and beverages are often presented in festive reusable packaging. In addition to providing environmental benefits, this type of packaging ensures multiple

brand touchpoints through the reusing of the packaging.

It is questionable whether this type of packaging is effective, since the production costs are high. Our

research shows that reusable holiday packaging is generally liked, with 75% of European consumers reporting that they enjoy being offered food and beverages with reusable packaging during the holiday season. Perhaps even more important: reusable packaging sells! Threequarters of Europeans agree that it increases their purchase intentions.

3. MERCHANDISING & MARKETING TRENDS

Creating unique packaging and products is not the only thing food and beverage brands do to leverage the peak season. To attract consumers, they often implement seasonal in-store merchandising and marketing during the holiday season. We have compared the following five common holiday season trends on likability and purchase intent:

How to use: In store information about how to use the product, for example the preparation of a particular recipe.

Product sample: The possibility to try out a sample of a food or beverage in store.

Charity: A collaboration with a charity, f.e. donating a certain percentage of all earnings.

Omni-channel: Providing a reference to online content with food or beverages, f.e. adding a QR-code to the packaging, leading to online product or campaign content.

Workshops: Organizing in store workshops, using the brand’s products.