It’s no secret that hard discount has been growing substantially in recent years, especially from a space growth perspective where discounters reported highest results last year, growing faster than other channels.

The growth of hard discount can be partly explained by the ranges that can now be found in this channel, with offerings extending beyond the entry level. Many established grocery brands are nervous about losing loyal customers as they switch to hard discount and wonder:

How can we design relevant promotions to retain our customers in hard discount channels?

We have asked our European community of app-users about their hard discounter consumer behaviour, providing you with insights on their shopping motives and preferences.

RECAP

- 38% of our European app users (N=3.575) state to have been doing more of their grocery shopping at hard discounters last month, compared to the same period last year.

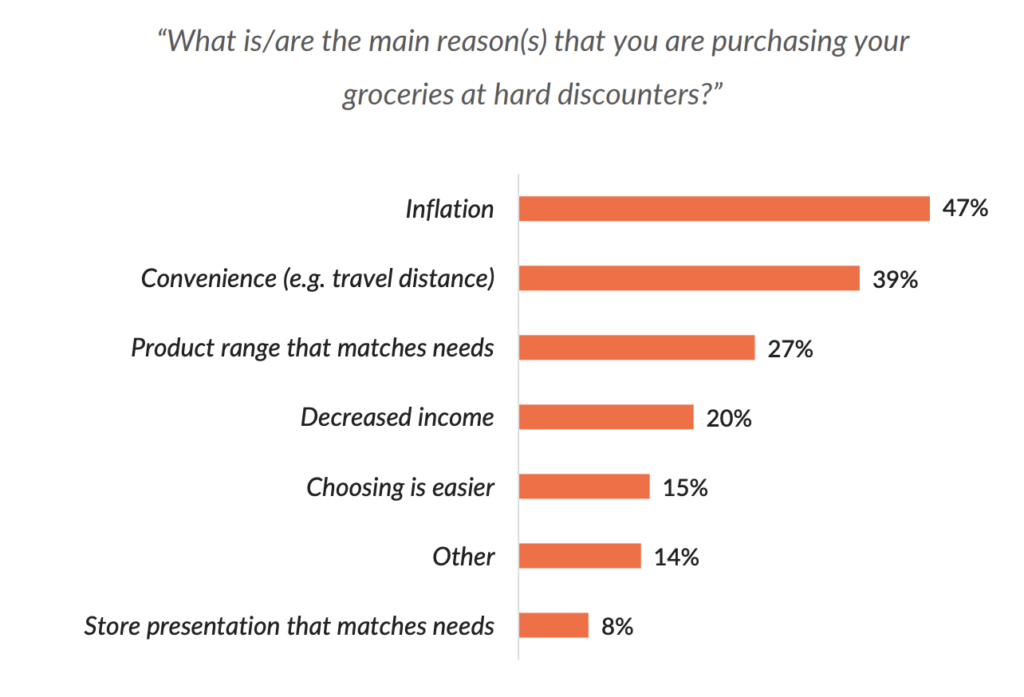

- Reasons they mention are inflation (47%), convenience reasons (39%), and product range (27%).

- Most of our app users are expecting to continue to shop at hard discounters more often (72%).

- 47% of our European app users state to be less satisfied with their supermarket(s) since they are shopping at hard discounters more often

- Our app users are looking for a one-stop-shop experience (59%) and a better availability of premium brands (34%) at hard discounters.

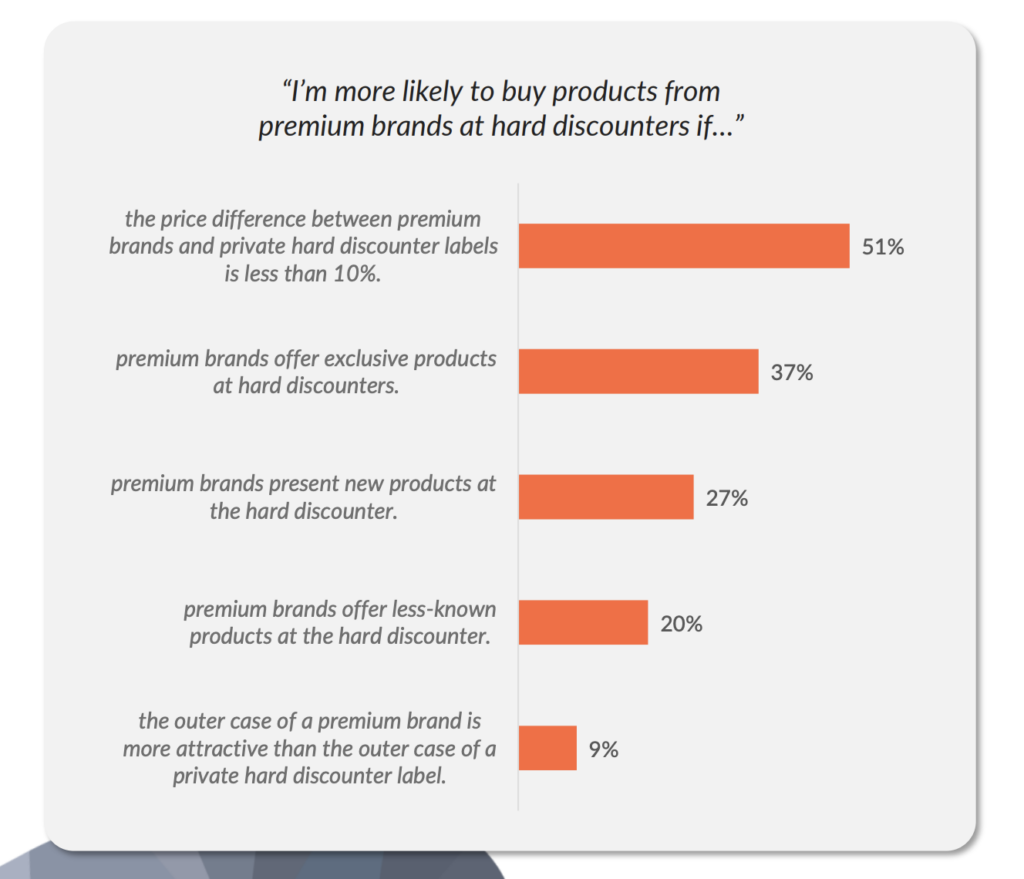

- 51% would be more likely to buy premium brands if the price difference between premium brands and private label would be less than 10%. Offering exclusive and new products could also attract discount switchers (consumers who have switched from supermarket to hard discounter) (37%; 27%).

1. SHOPPING RATIO

Only 5% never shops at hard discounters.

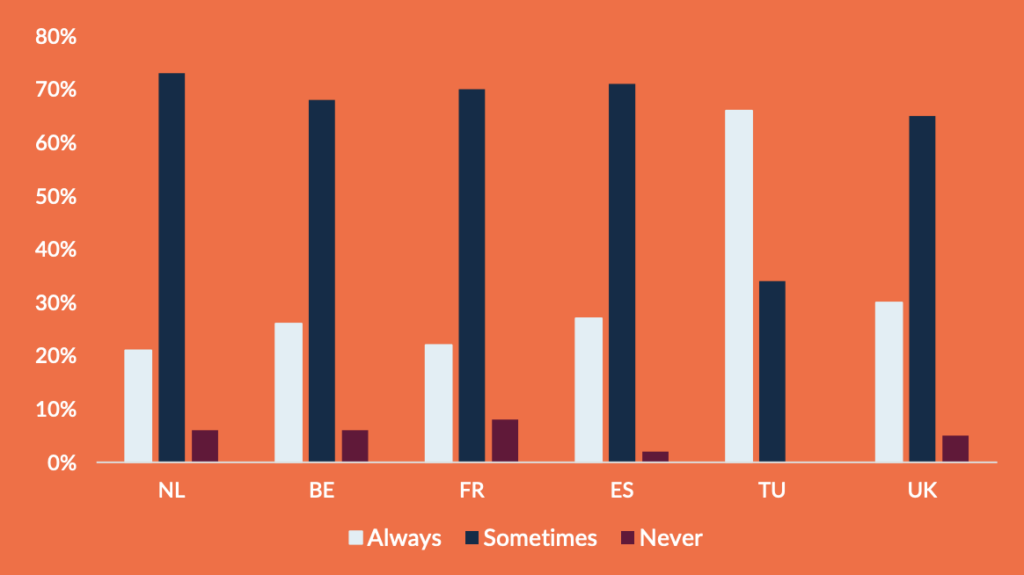

Most European consumers visit hard discounters ‘sometimes’ (64%), or even ‘always’ (32%) for grocery shopping. Turkish consumers visit hard discounters most, with 66% of them stating to shop there ‘always’, and 34% ‘sometimes’. On average, only 5% of European consumers never go to hard discounters for their grocery shopping.

“How often do you do your grocery shopping at hard discounters?”

Confirming previous research, no less than 38% of European consumers state to have been doing more of their grocery shopping at hard discounters last month, compared to the same period last year. For consumers from the UK and Turkey, this number is above average: 40%; 66%.

“Over the last month, have you been doing more or less of your grocery shopping at hard discounters, compared to the same period last year?”

The same – 48%

Less – 14%

More – 38%

Not only do most consumers shop more often, or at least as much as before, at hard discounters, the majority is also expecting to continue to shop at hard discounters more often (72%). Besides, only 3% of European consumers are expecting to fully go back to doing grocery shopping at ‘regular’ supermarkets.

2. SHOPPING MOTIVES

The motives behind the increasing frequencies of shopping at hard discounters may seem obvious, with inflation as the main driver (47%). However, convenience reasons (39%), and product range (27%) were also mentioned by many European consumers. Product ranges that meet the needs of consumers were even the main driver for Spain (43%). An interesting fact, given that de product range of hard discounters is dominated by private labels.

3. SUPERMARKETS

47% of European consumers state to be less satisfied with their supermarket(s), since they are shopping at hard discounters more often.

Previous research already showed that store satisfaction of traditional retailers is lower when a hard discounter is present¹. Our research confirms that 47% of European consumers state to be less satisfied with their supermarket(s) since they are shopping at hard discounters more often. This decrease in satisfaction might be caused by an increasing ‘high price’ association with supermarkets after a hard discounter enters the market¹.

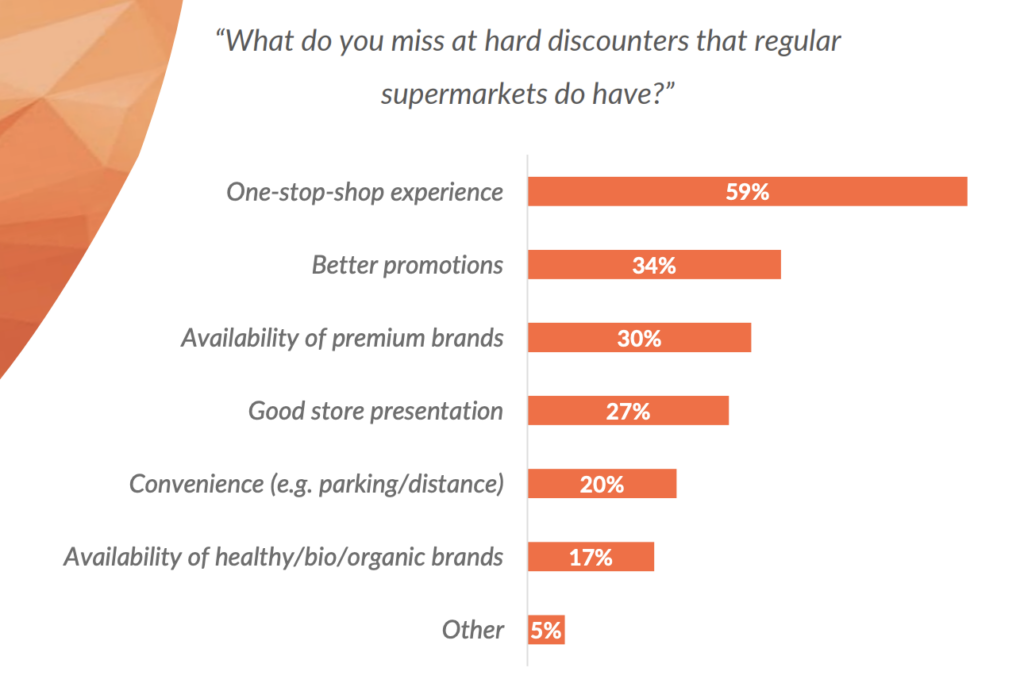

Subsequently, we asked our community what they are missing at hard discounters that they feel that other type of supermarkets do have. A ‘one-stop-shop experience’ is the main missed factor for most European consumers (59%), pointing out that the product ranges at hard discounters still don’t cover all needs of many consumers. Besides, they would like to see better promotions (34%) and a better availability of premium brands (30%) at hard discount stores.

“European consumers are looking for a one-stop-shop experience (59%) and a better availability of premium brands (30%).”

4. PREMIUM BRANDS

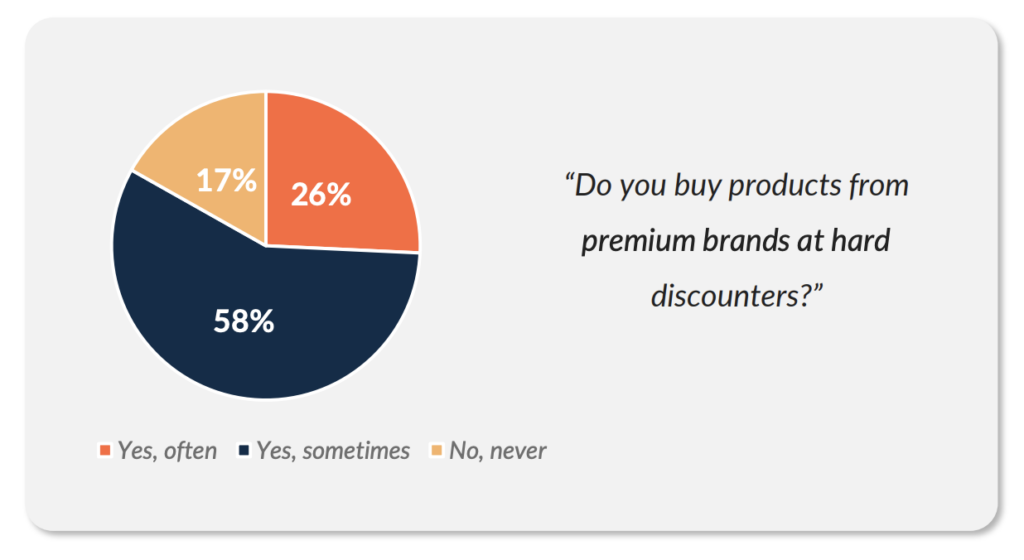

As the substantial growth of hard discounters clearly have consequences for premium brands, we finally asked our community about their behaviour when it comes to premium brands. It turns out that, although the availability of premium brands at hard discounters could be better according to consumers, 58% of them buy premium brands at hard discounters ‘sometimes’, and 26% ‘often’. For consumers who buy little to no premium brands at hard discounters, this is mainly because of the following three reasons:

- Private labels are just as good as premium brands (48%).

- Premium brands are too expensive (39%).

- There is a lack of availability of premium brands (29%).

With the increase in shopping frequencies at hard discounters, and only 26% of hard discount visitors buying premium brands often, it’s important for premium brands to get a handle on how to attract discount switchers. Our research shows that 51% would be more likely to buy premium brands if the price difference between that brand and private label would be less than 10%. Besides, offering exclusive and new products could convince a significant part to buy a premium brand (37%; 27%).

The findings presented in this report are based on the results of an investigative task submitted to the Roamler community during one month (May 2022). The purpose was to determine the community’s preferences when it comes to buying fresh produce products. The findings reflect data collected from 3.575 respondents, located in France, Spain, the United Kingdom, Turkey, Belgium, and the Netherlands.

¹Hunneman, A., Verhoef, P.C., & Sloot, L.M. (2021). The impact of hard discounter presence on store satisfaction and store loyalty. Journal of Retailing and Consumer Services, 59, pp. 1-13.