Riders on electric bikes zoom from small warehouses to customers’ homes within 10 minutes, delivering fruit, milk, and other convenience goods. From Germany to India: the 10-minute grocery delivery startups are emerging everywhere. Expert’s state there is clearly a high demand for this service, and the question that arises is:

What drives this high demand for 10-minute grocery delivery, where is the demand greatest, and for which products do consumers want to use this service?

We asked our large community of European mobile users to tell us about their consuming behaviour and preferences when it comes to 10-minute grocery delivery services. Read all our interesting findings in this month’s Consumer Report.

RECAP

▪The older the European consumer, the less he or she uses 10- minute grocery delivery services.

▪ Most customers of the service are living in Spain and in The Netherlands. Belgians make use of the service least.

▪ In case of the unavailability of 10-minute grocery delivery services, 81% of European consumers state they are willing to use the service if it was available in their region.

▪ Average order sizes range from 3 to 5 products and from €11 to €20 euros.

▪ Dinner ingredients is the most ordered product category.

▪ Gorillas has a favored position throughout Europe.

▪ A good working app is the main motive behind brand favorability.

1. USERS

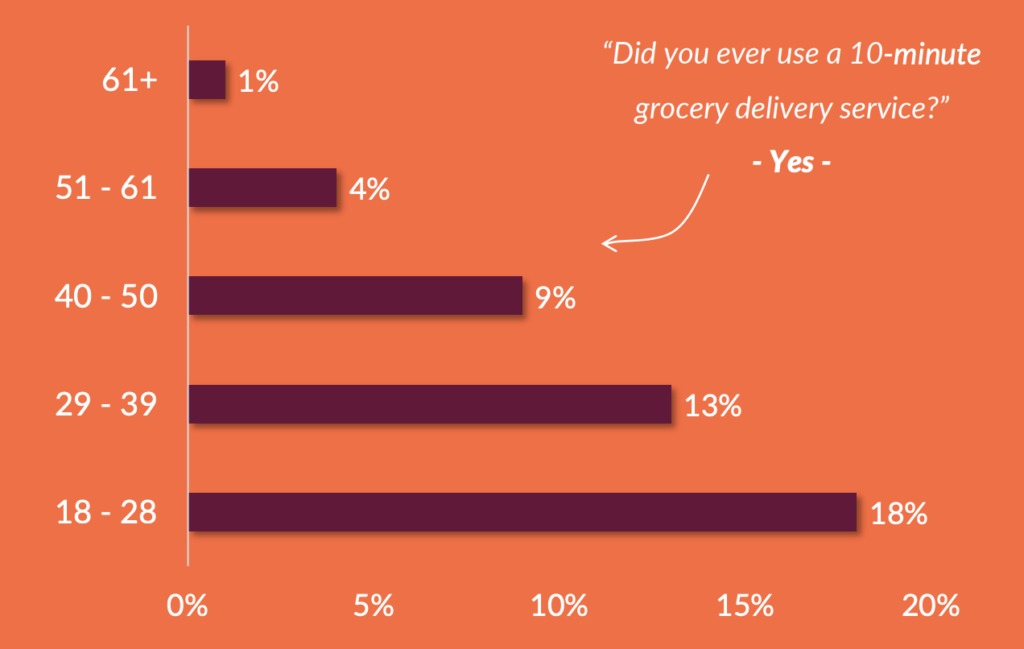

Users by age: the older, the less

When it comes to the age of the average 10-minute grocery shopper, most experts argue that

the service is being used by people of all ages, stating that the online grocery service has been widely adopted by all consumers, including older demographics.

However, our findings show that the following applies when it comes to age and the use of 10- minute grocery delivery in Europe: The older the consumer, the less they use 10-minute grocery delivery services. Millenials and GenZ make up the largest group of users.

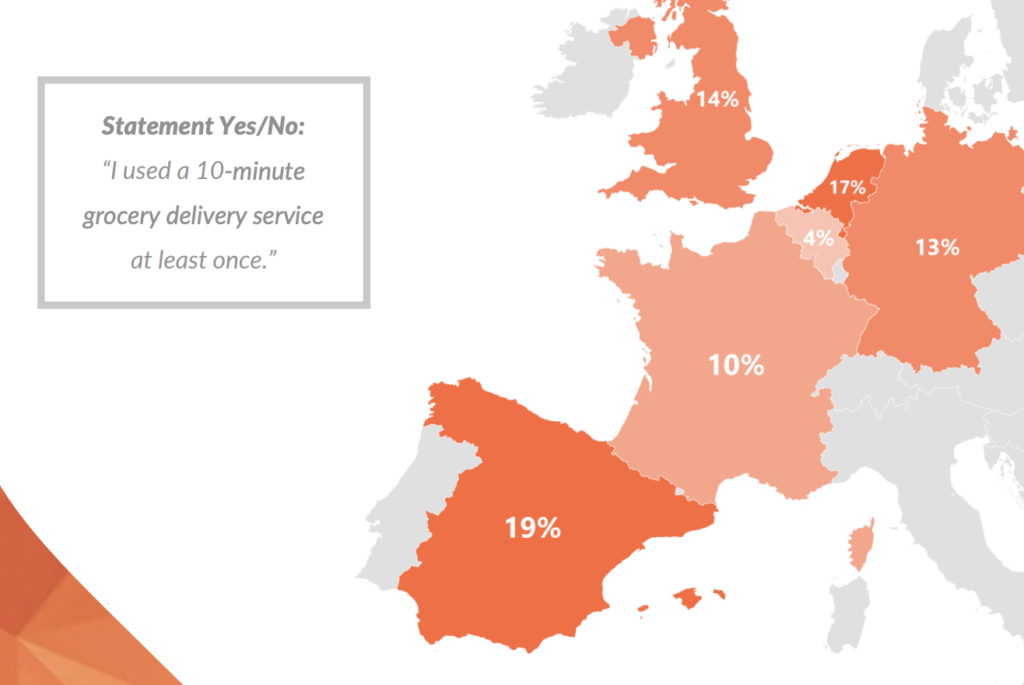

Users by country: European differences

Services like Gorillas, Zapp, and Getir are available throughout all of Europe, while grocery shopping rituals differ greatly between European countries. Do all European consumers really have a need for such fast shopping services? We compared the use of the services in six European countries.

Our results show that Belgians are least likely to get their groceries delivered within 10 minutes, compared to other European countries (4%). Most users of the service are living in Spain (19%) and The

Netherlands (17%).

“Most customers are living in Spain and in the Netherlands.”

Users by region: Regional differences

“I used a 10-minute grocery delivery service at least once”

The Netherlands – Top 3 regions

- Noord-Holland 29%

- Zuid-Holland 20%

- Utrecht/Brabant 18%

Belgium – Top 3 regions

- Antwerp 9%

- Flamish Brabant 8%

- West Flanders 2%

France – Top 3 regions

- La Guadeloupe 25%

- Alpes Côtes d’Azur 16%

- La Réunion 17%

Spain – Top 3 regions

- Com. de Madrid 45%

- Castilla La Mancha 31%

- Aragón 29%

Germany – Top 3 regions

- Hessen 33%

- Baden-Württembrg 16%

- Bayern 15%

United Kingdom – Top 3 regions

- London 38%

- North West 15%

- South East 10%

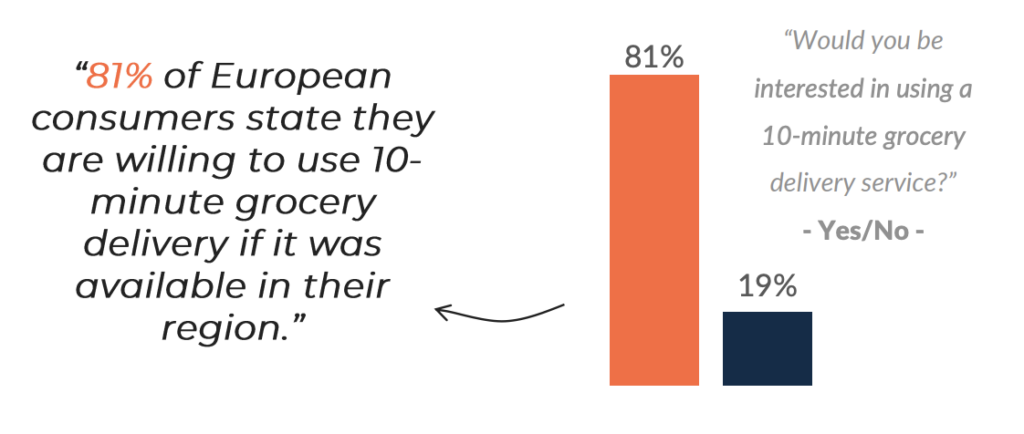

2. AVAILABILITY

As a reason for not using it

The unavailability of the service in some European regions is the main reason for not using it (42%). That

there is large unutilized potential, is apparent from the fact that 81% of consumers in these regions state

that they would use the service if it was available in their region.

They are mostly planning on using the service for ordering dinner ingredients (68%), lunch ingredients (51%), or ready-made meals (46%). Beauty, care and cleaning products are least expected to be ordered with 10-minute grocery delivery services, once it’s available to them (20%)

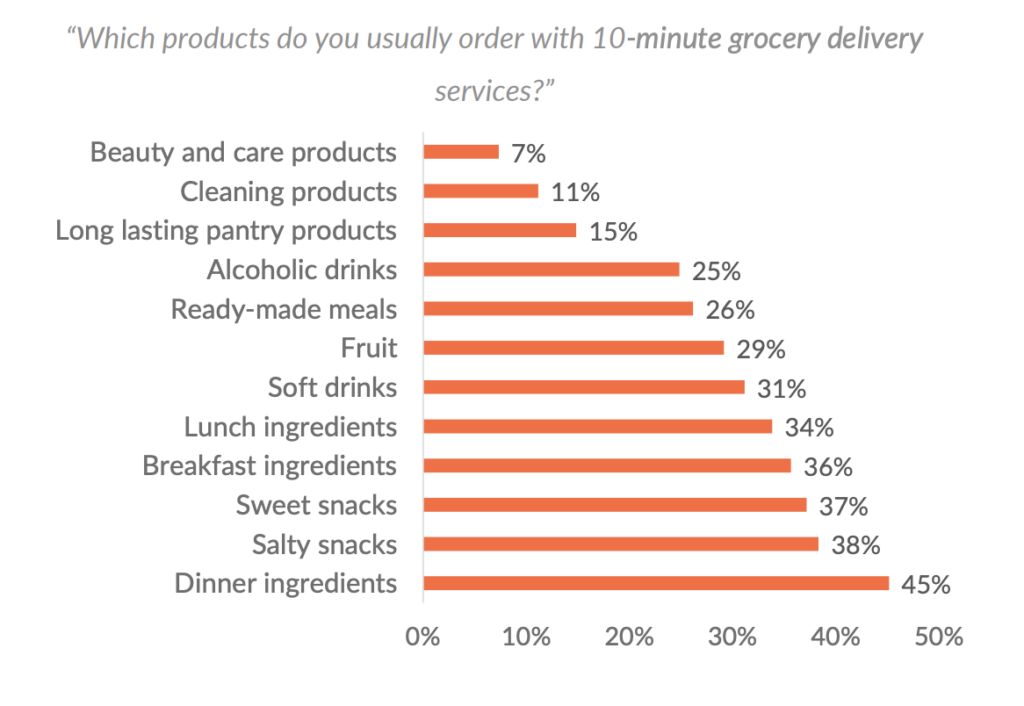

3. BEHAVIOUR & MOTIVES

Buying behaviour

On average, European fast grocery delivery customers buy 3 to 5 products per order (44%), spending €11 to €20 euros (50%). 10-minute grocery delivery providers should not worry about charging more for their products than regular stores do, as 73% states they find it fair if products are more expensive than products in supermarkets.

Which products do Europeans not want to leave the couch for? The answer: for a wide range of products. But, mostly for dinner ingredients (45%), salty snacks (38%), and sweet snacks (37%).

4. BRAND FAVORABILITY

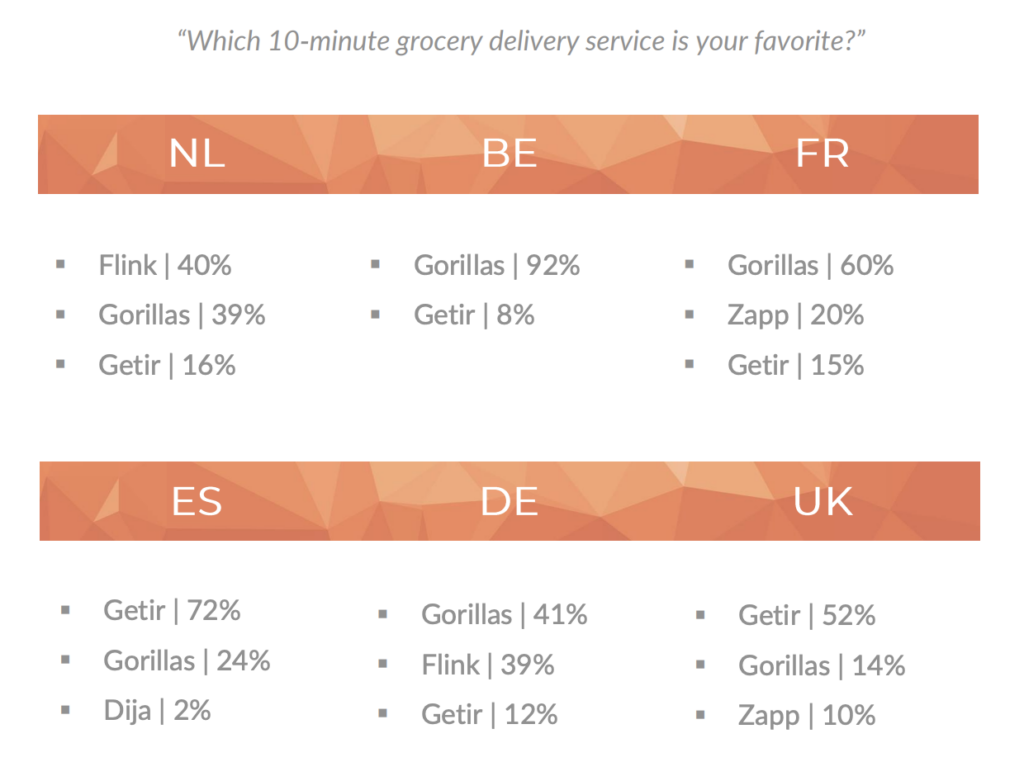

The fast rise of multiple 10-minute grocery delivery services gives consumers the luxury to pick their favorite app. Founded in 2020, Gorillas already has a favored position throughout Europe, as 45% of all European consumers indicate Gorillas is their favorite service.

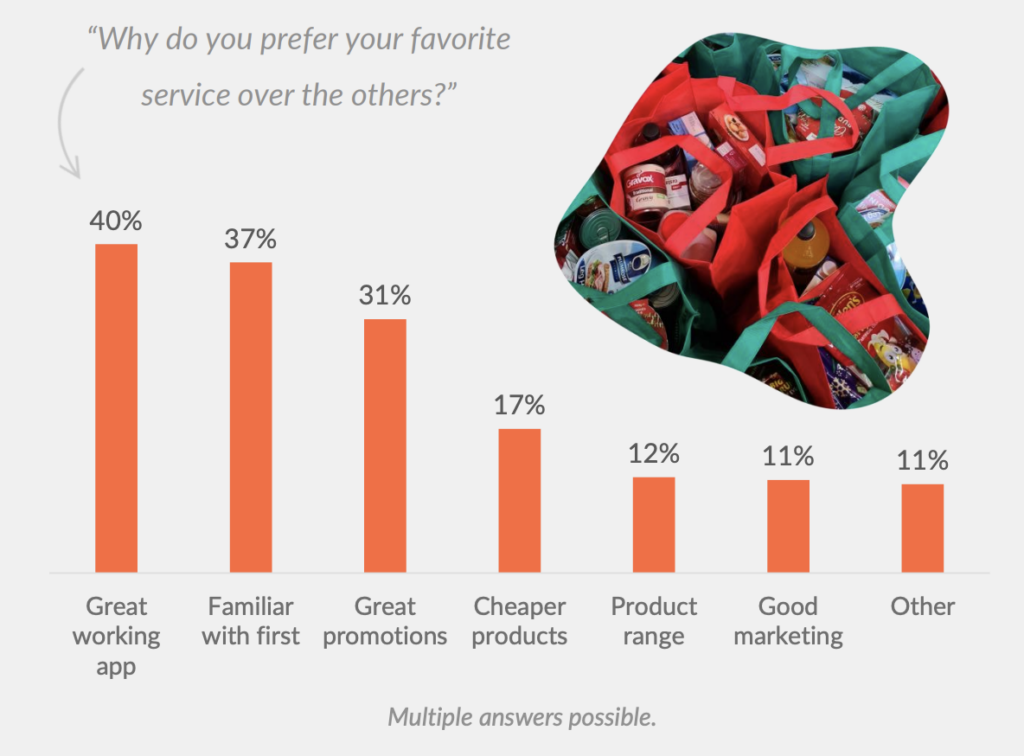

Brand selection: Consumer motives

For services, it is important to know how consumers select their favorite brands. Based on our findings, we could state that consumers find it most important that the app works properly, as this is the main motive for brand selection (40%). Secondly, it is beneficial to be the first known service in the region; 37% of European consumers simply prefer the service they were familiar with first.

Lastly, offering interesting promotions can certainly play a role in brand selection. For 31% of European consumers, this is a reason to pick a service over other services.

The findings presented in this report are based on the results of an investigative task submitted to the Roamler Community during one month (February 2022). The purpose was to determine the communities’ preferences when it comes to 10-minute grocery delivery services. The findings reflect data collected from 4.642 respondents, located in France, Spain, The United Kingdom, Germany, Belgium, and The Netherlands.