- Insights

The impact of rising coffee prices on the Dutch hospitality industry

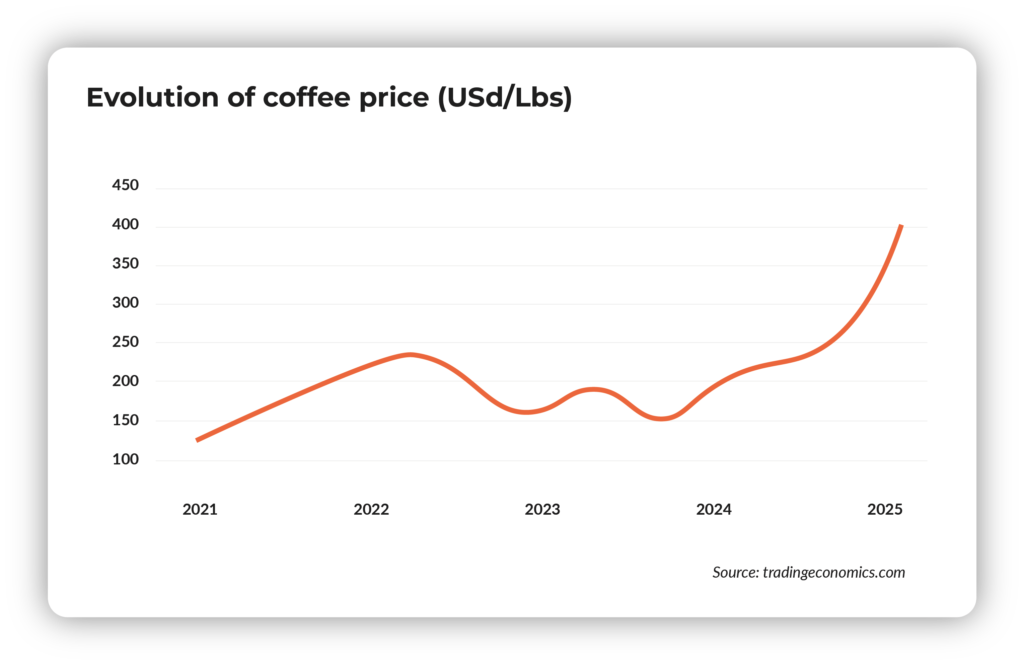

The average hospitality entrepreneur, coffee producer, or enthusiast has probably noticed: the massive price increases of coffee beans in recent years. Over the past five years, the price of Arabica beans (which account for 75% of global coffee production) has nearly quadrupled, rising from $1.09 per pound in March 2020 to nearly $4 today.

Especially in the past year, prices have surged significantly, increasing by around 100%!

What’s Causing This?

This price surge is not without reason. Poor harvests due to climate change and geopolitical developments in the world’s largest coffee-producing countries—Brazil, Colombia, and Vietnam (which together account for 62% of global coffee production, source: USDA)—have led to a significant supply shortage and, consequently, a rise in prices.

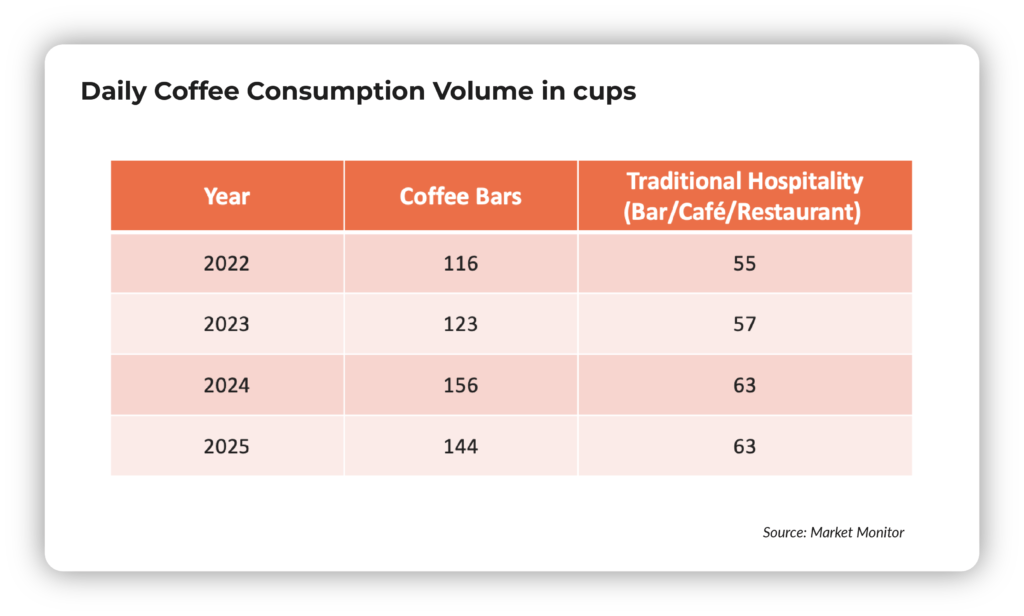

Naturally, this increase impacts the profitability of producers and, as a result, the prices consumers pay. We analyzed the data to determine whether this has led to a decline in coffee consumption within the hospitality industry or if consumption has largely remained unchanged.

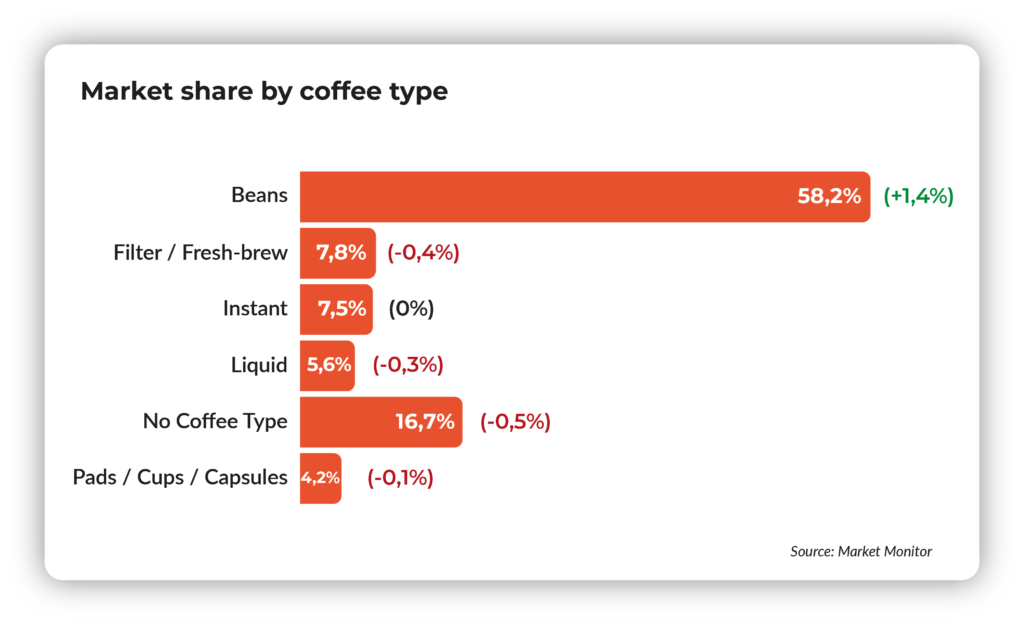

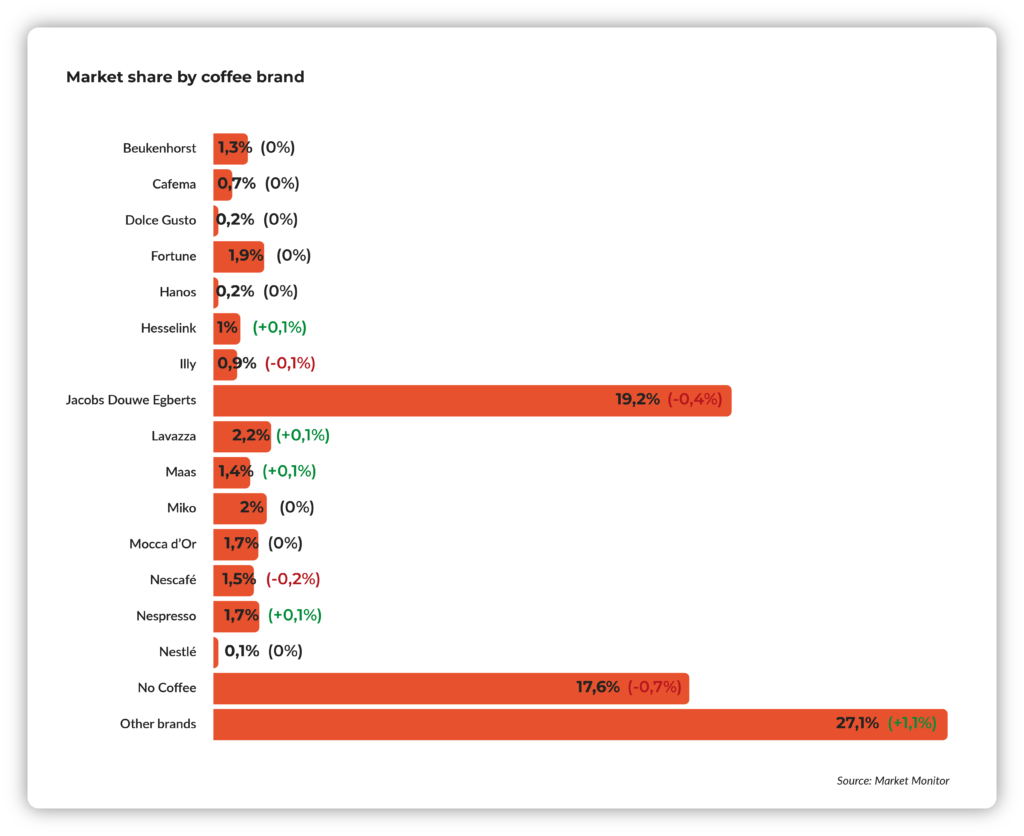

Additionally, we examined whether there have been notable shifts among different coffee types (beans, filter coffee, pods, instant coffee, etc.) and market share of brands over the past year.

What Does the Data tell us?

When we consult our Market Monitor data and analyze different coffee types, we see that the share of coffee beans has increased by 1.4 percentage points compared to 12 months ago. Meanwhile, the share of other coffee packaging types and locations where coffee is not served has declined compared to last year.

Additionally, we observe a rise in popularity of coffee producers outside the traditional major players, while established brands such as JDE, Nescafé, and Illy are experiencing a decline or stagnation.

These trends align with the growth in the number of coffee roasteries over the past decade. Consumers are increasingly seeking “specialty coffee” (high-quality coffee beans) (Source: Roasthouse).

It appears that despite rising prices—and the fact that smaller producers generally charge higher prices—the average Dutch consumer places increasing value on a quality cup of coffee. This is supported by data from 2022 onward in coffee bars and traditional hospitality establishments (bars/cafés, restaurants) regarding the volume of coffee served daily. We see interesting trends, particularly an upward trend in both segments.

Conclusion

We can conclude that, despite market fluctuations, coffee consumption within the hospitality industry has remained stable or even increased. Additionally, we see a growing demand for high-quality coffee beans produced by smaller brands, putting increasing pressure on the major players in the coffee industry. Our research highlights the strong love for coffee among Dutch consumers. Despite rising raw material and retail prices, coffee consumption outside the home remains steady—or even higher.