Dining habits and restaurant culture differ significantly across Europe, with each country reflecting its own traditions. In this article, we explore key trends in the European restaurant industry, focusing on the evolution of different restaurant types, the variety of popular cuisines, and the meals most commonly served across various countries.

💡 This article is focused on two types of restaurants that we distinguish in our database:

• Fast Casual restaurant: a type of restaurant that falls between fast-food and casual dining. Key characteristics of fast casual restaurants include limited/no service (self-service), high turnover rate of tables, lower price range, limited or themed menu (pancakes, pasta).

• Social Dining restaurant: dining establishment with full service, extensive menu and a higher price when compared to fast casual restaurants.

Overview of the European Restaurant Landscape

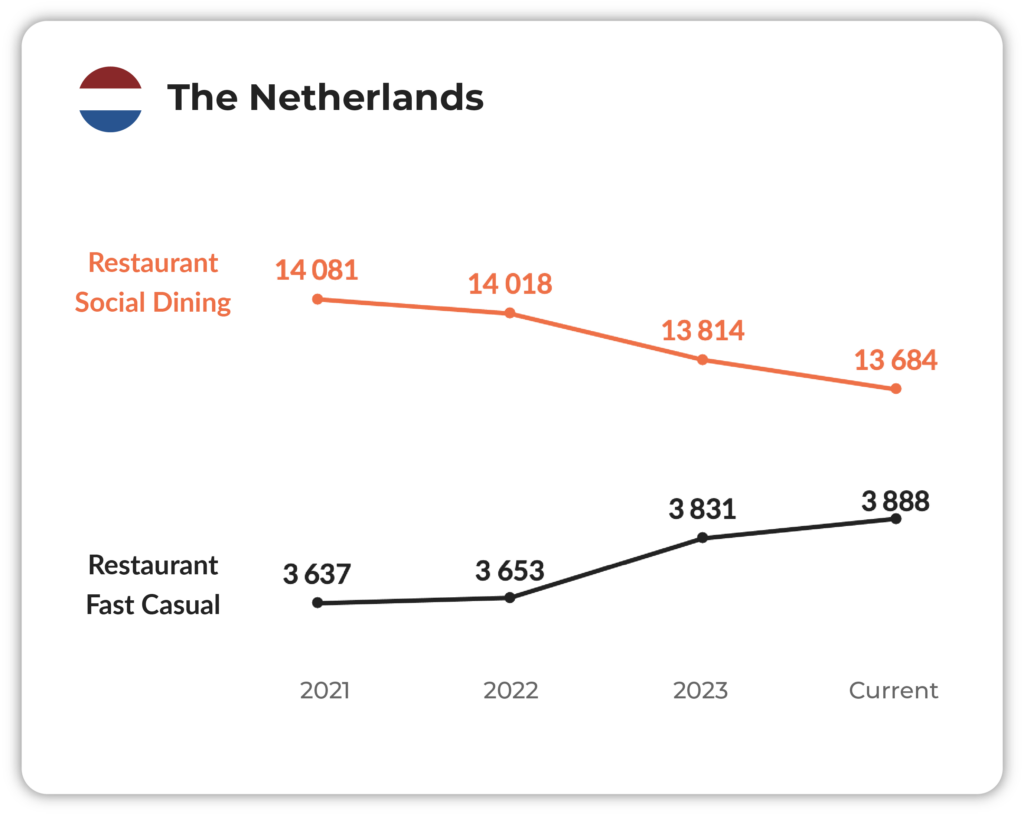

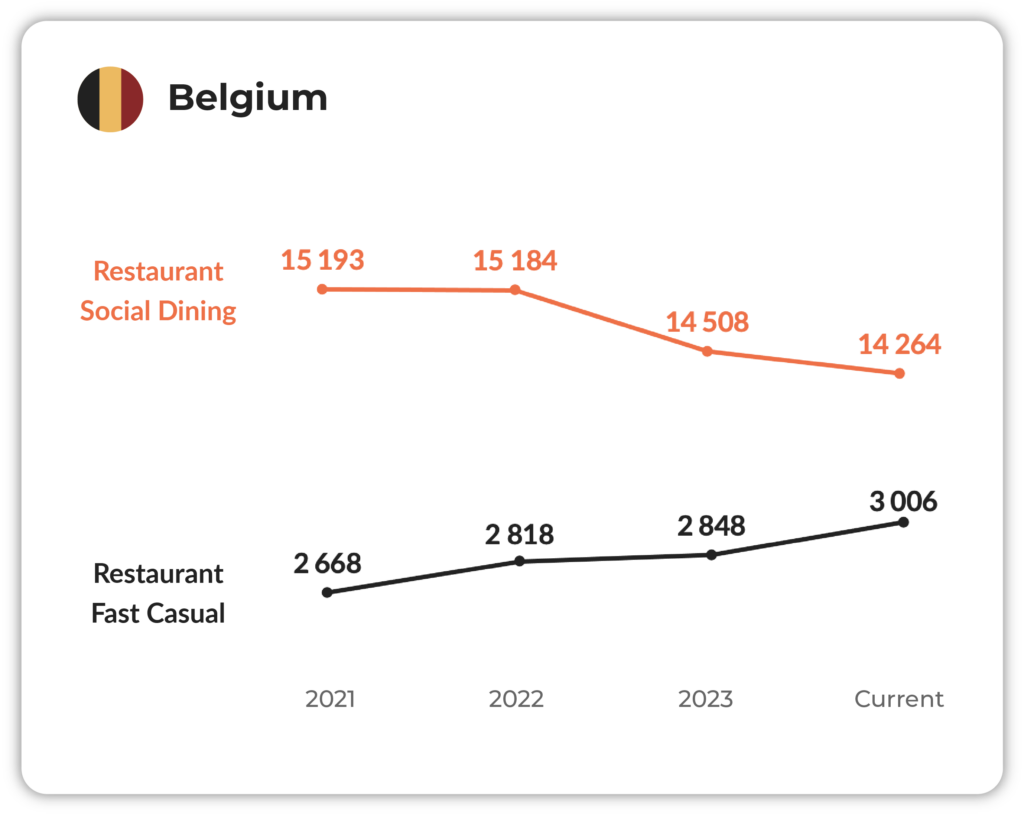

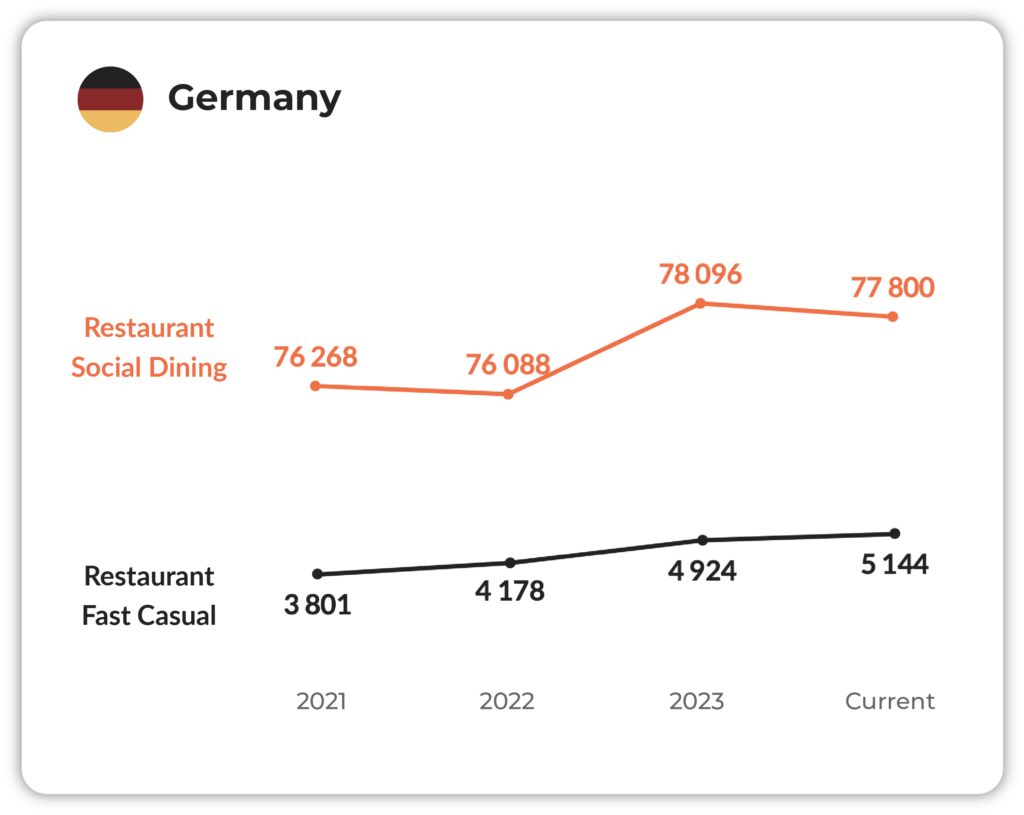

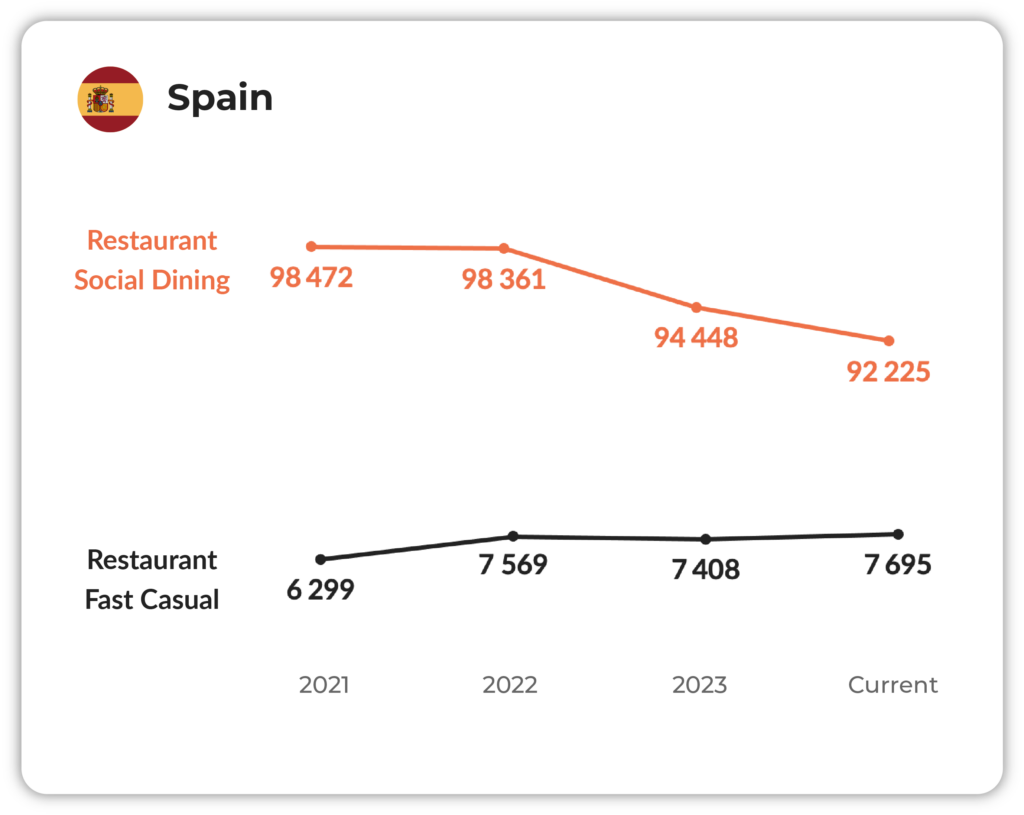

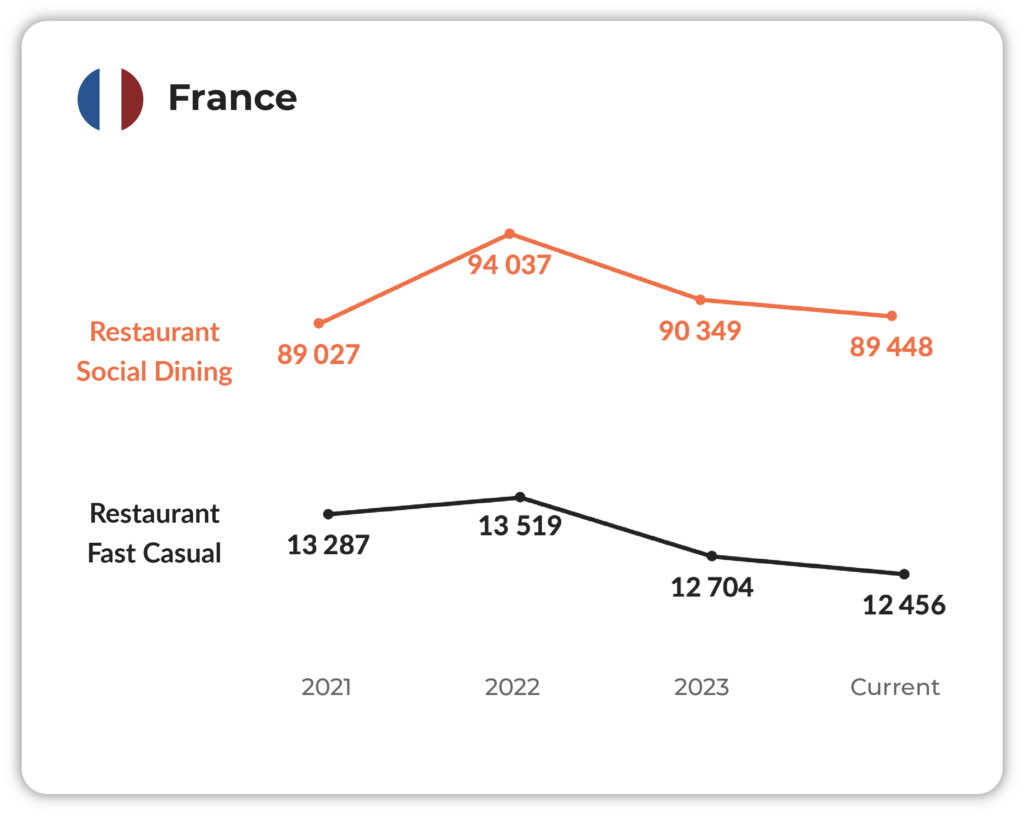

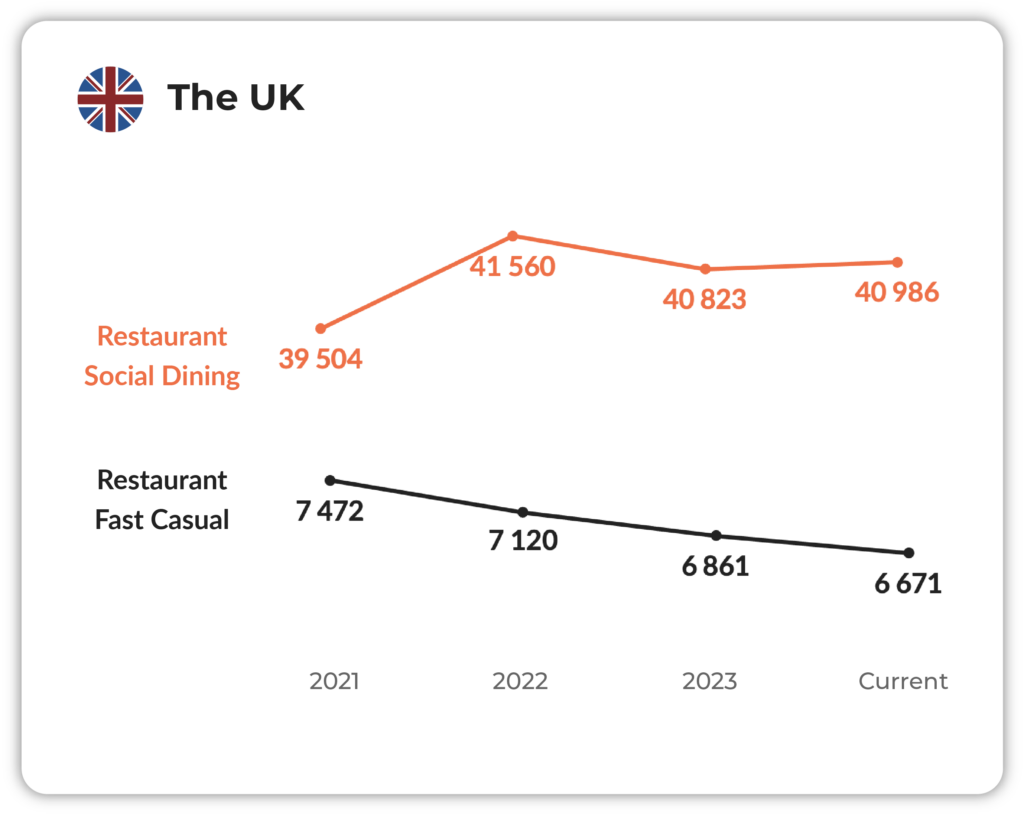

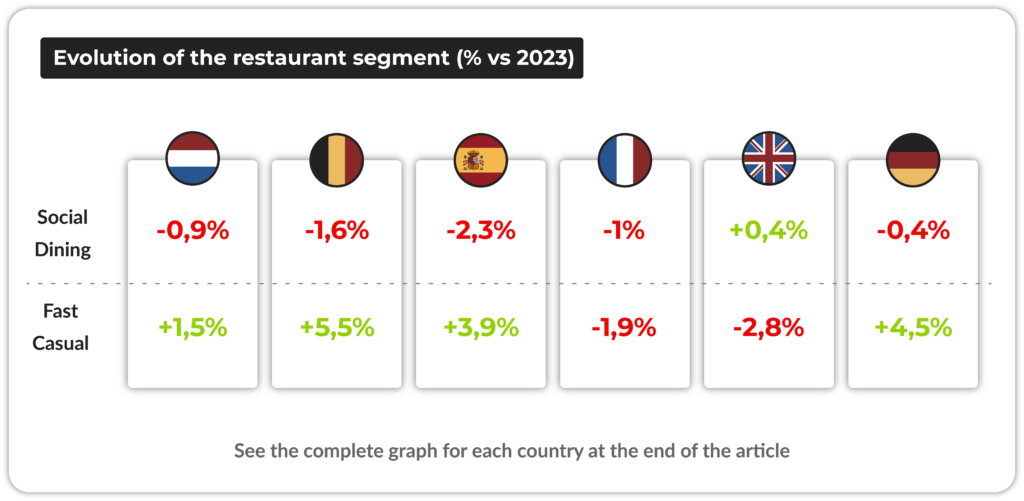

Let’s take a closer look at the current state and evolution of the two restaurant types across Europe. We will examine the changes in both restaurant types between 2023 and 2024 across several countries. For insights of the development between 2021 and 2024, please refer to the graphs below this article.

Social Dining restaurants: Under Pressure in most of Europe

As noted in a previous article, social dining restaurants have faced widespread challenges over the past year, a trend that persists in most European countries.

Compared to 2023, the number of social dining restaurants has steadily decreased, with Spain showing the steepest decline (-1.6%). Belgium and France have also seen reductions, driven by financial uncertainty and changing consumer behavior. Due to rising prices from inflation and consumer financial uncertainty, individuals are being more cautious with their spending. This trend directly affects higher-cost dining options, such as social dining restaurants, making it challenging for these establishments to remain open.

The only exception to this downward trend has been the UK, which saw a slight increase in social dining restaurants (+0.4%). However, this growth is modest and suggests that even in markets where the segment remains stable, it may be vulnerable to broader economic pressures.

Fast Casual restaurants: Continued Growth despite Challenges

In contrast, the fast casual restaurants have shown more resilience. While France (-1.9%) and the UK (-2.8%) have experienced declines in 2024 when compared to 2023, other countries have seen substantial growth. Belgium and Germany lead the way, with growth rates of +5.5% and +4.5% respectively. Spain has also experienced an increase in this segment, with a growth rate of 3.9% compared to 2023.

This trend reflects a shift in consumer preferences toward more convenient, affordable, and time-efficient dining experiences. The overall positive trend across Europe suggests that these types of restaurants are becoming increasingly popular among those consumers looking for quick yet satisfying meal options.

Culinary Preferences and the Rise of National and Plant-Based Cuisines

💡 How did we calculate this?

In our Location Database, each restaurant is labeled by kitchen type. It is then very easy to calculate the most recurring kitchen type in every country. Want to try our Location Database? Request a demo here

Culinary traditions continue to play an important role in shaping the European restaurant landscape. In countries such as France, Belgium, and Spain, more than 20% of restaurants serve a fully national cuisine, reflecting a strong connection to local food culture.

Another trend influencing the evolution of both fast casual and social dining restaurants is the increasing demand for Vegetarian Options. Countries such as the Netherlands (18%), the UK (15.9%), and Germany (14.9%) have seen plant-based cuisine rise to the top. This shift is evident in both restaurant types, with consumers seeking healthier and more sustainable dining choices. In the UK, the influence of multiculturalism is also clear, with Indian cuisine ranking third in popularity, further diversifying the offerings in fast casual and social dining establishments.

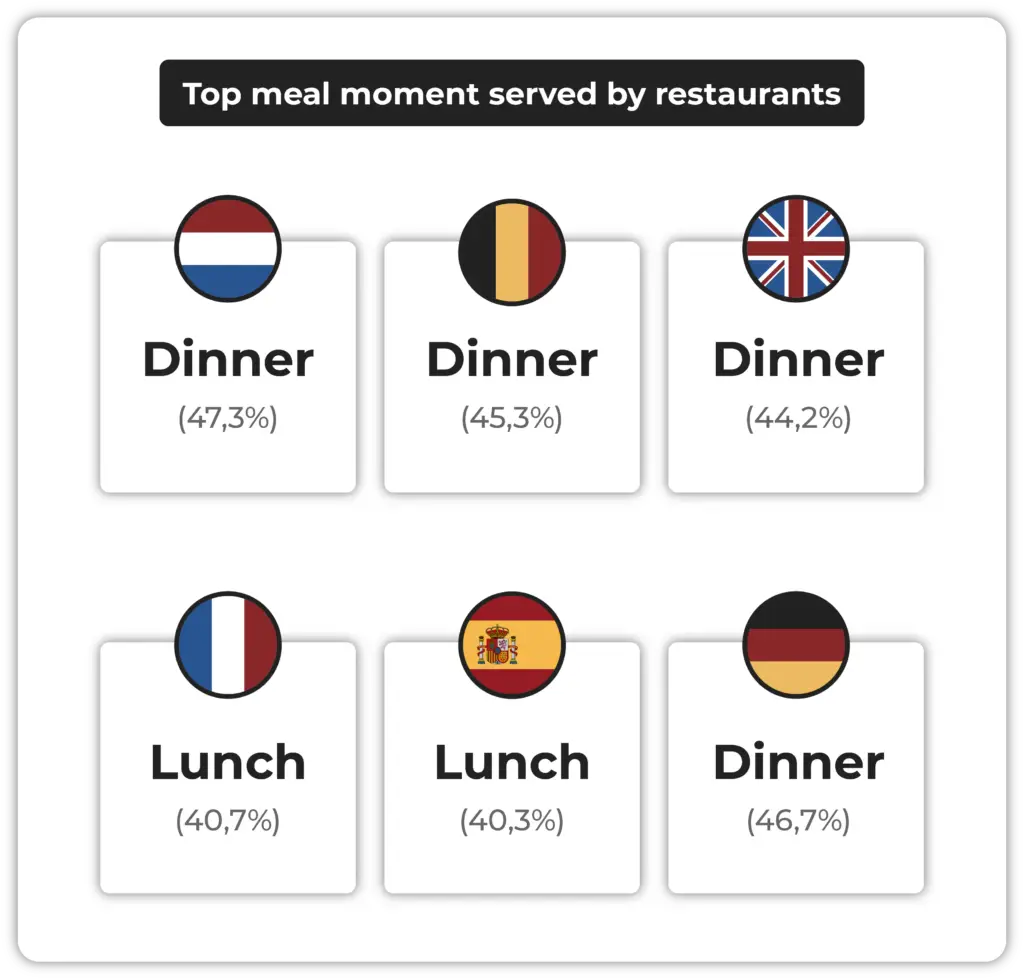

Different Meal Preferences: North vs. South

The landscape of restaurant establishments in Europe is also shaped by meal preferences, which tend to vary between northern and southern Europe.

In northern Europe, including Germany and the Netherlands, dinner is the dominant meal, with many restaurants primarily focusing on evening service. In the Netherlands, 47.3% of restaurants serve dinner, while in Germany, the number is 46.7%. Dining times tend to be earlier, with most people eating between 6 and 7 PM, reflecting a faster-paced lifestyle where dinner is the main social meal.

In contrast, southern European countries like France and Spain place more emphasis on lunch. In France, 40.7% of restaurants serve lunch, and in Spain, 40.3% focus on this meal. The tradition of long lunch breaks remains a cultural norm, influencing how restaurants schedule their service and contributing to the slower pace of life in these regions. Breakfast service is also more common in southern Europe (around 22%), compared to northern Europe, where it averages around 13%.

Conclusion: The Future of Fast Casual and Social Dining in Europe

The evolution of Fast Casual and Social Dining establishments across Europe highlights the impact of economic conditions and shifting consumer preferences. Fast Casual restaurants are on the rise, driven by demand for convenience, affordability, and flexible dining experiences. On the other hand, Social Dining faces challenges, particularly in countries where higher-priced dining options struggle to compete in a more cautious economic climate.

Local culinary traditions and emerging trends like plant-based diets will continue to shape the future of European dining. Fast Casual restaurants, in particular, are well-positioned to adapt to these changes, providing the blend of quick service and quality that today’s consumers increasingly seek. Meanwhile, Social Dining establishments will need to innovate and adjust to remain competitive in this evolving landscape.

Discover the full potential of your market with our Location Database

Detailed graphs - Evolution of the restaurant segment in Europe