Candy is happily enjoyed anytime, but the last months of the year are usually “sweeter”, thanks to the many events where eating and distributing candy is a tradition. Think of Halloween, Thanksgiving, Saint Nicolas, Hanukkah and of course Christmas!

We felt this was the perfect time to ask our large community of mobile users about their candy consumption routines.

Curious about the relationship between Europeans and candy? Read all the findings in our latest Consumer Report.

MOST EUROPEANS CONSUME CANDY

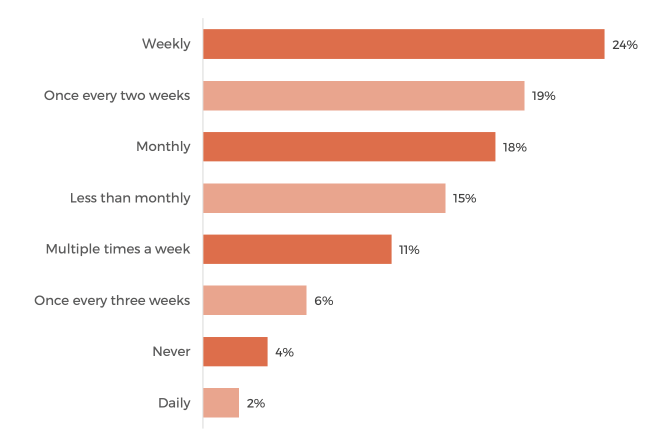

86% of Europeans eat candy. The majority of European consumers state to buy candy on a weekly basis (24%), while 19% do it every two weeks

FUN FACT

• Germans seem to buy candy most often, as 56% of consumers buy it at least once a week.

• French shoppers buy candy the least, as 26% of consumers state they do it less than monthly

TOP 4 REASONS NOT TO EAT CANDY

1 – Preference for savory snacks …47%

2 – Too many (refined) sugars …42%

3 – Too many calories …29%

4 – Bad for teeth …27%

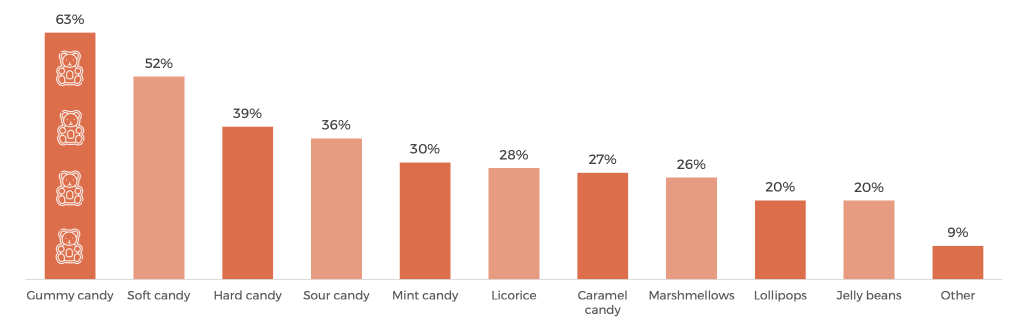

FAVORITE CANDY TYPES

86% of Europeans eat candy. The majority of European consumers state to buy candy on a weekly basis (24%), while 19% do it every two weeks

FUN FACTS

• With 59% of preferences, licorice is very popular in the Netherlands, especially when compared to Spain (9%) and Belgium (11%).

• Belgium scores exceptionally high on consuming “sour candy” (60%).

EUROPEAN CHANNEL PREFERENCES

91% of Europeans mostly buy candy in supermarkets. When it comes to other channels, shoppers have different habits and preferences.

STORE FACTS

• Spanish consumers buy their candy in candy stores (71%) far more often than the European average (25%),

• The convenience channel is very popular in the UK, with 51% of Brits shopping for candy in convenience stores, as opposed to a European average of 18%.

• Dutch, Belgian and German consumers opt for drug stores too (≥ 21%). Whereas in the UK, Spain, France and Italy this channel is the least popular (≤ 4%).

• French consumers score the highest preference for department stores (57%). In the rest of Europe, this channel is far less popular (20%).

PURCHASING PREFERENCES

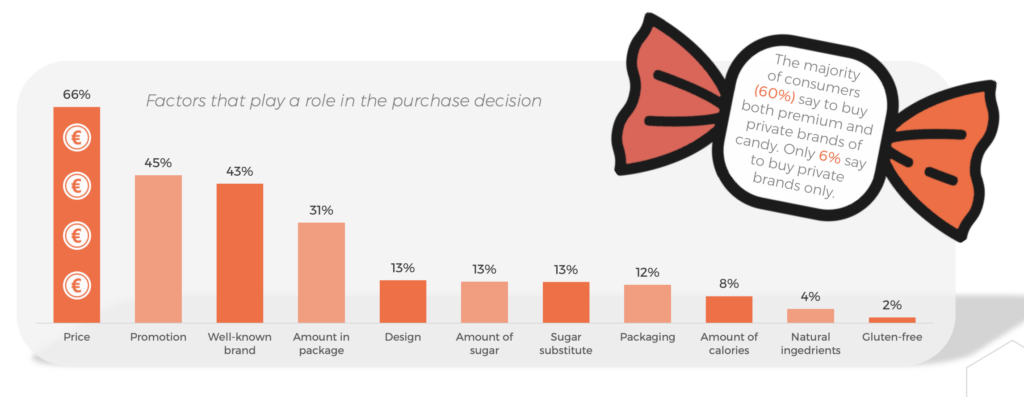

Price (66%), Promotion (45%) and brand awareness (43%), are the top 3 factors that consumers take into account when purchasing candy.

PURCHASING ROUTINES

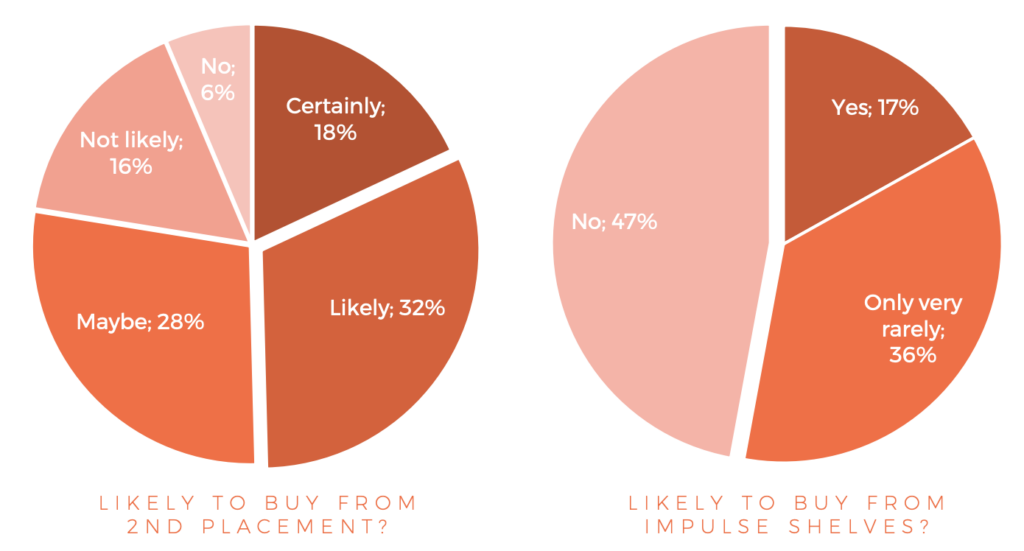

32% of Europeans state it is “likely” they will buy candy when finding it at a “second placement”. Only 6% state not to be affected by such promotions at all.

47% of Europeans state not to be tempted to grab single sized candy-packages at cash registers. On the opposite note, 17% of consumers easily give in to impulse sections.

FUN FACT

German and Dutch consumers are the least affected by impulse shelves. In both countries, 60% of consumers resist the temptation.

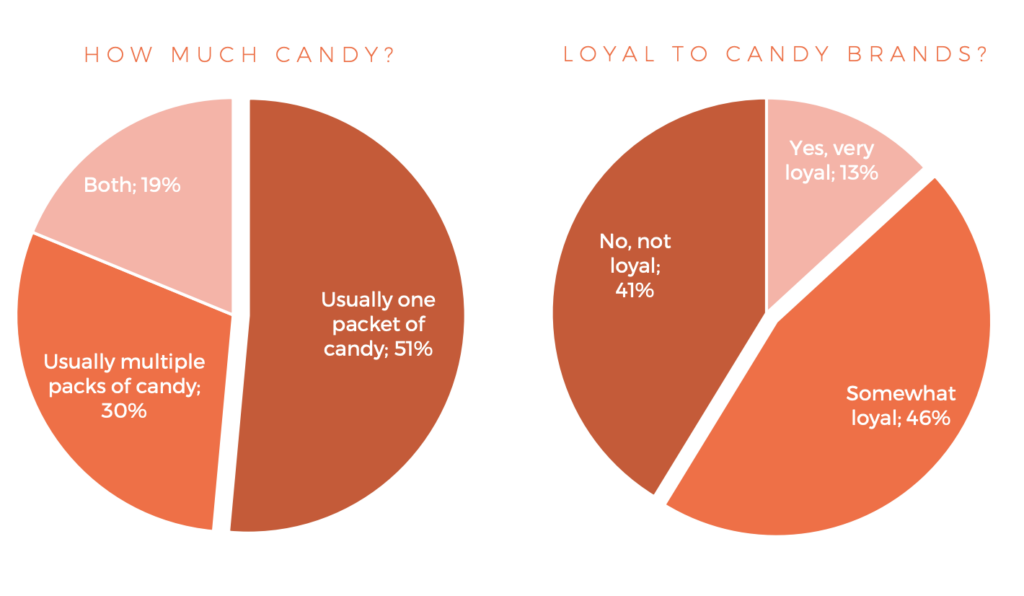

HOW MUCH CANDY?

The majority of Europeans (51%) tend to buy one pack of candy at a time. 30% of consumers, instead, buy multiple packs to store away. When it comes to loyalty, only 13% of Europeans state to be very loyal towards their favorite candy brands.

FUN FACT

Despite the persisting trends around healthier eating practices, our research shows that candy with sugar substitutes like Stevia is not very popular. Only 8% of consumers say to “often” consume candy with sugar substitutes.

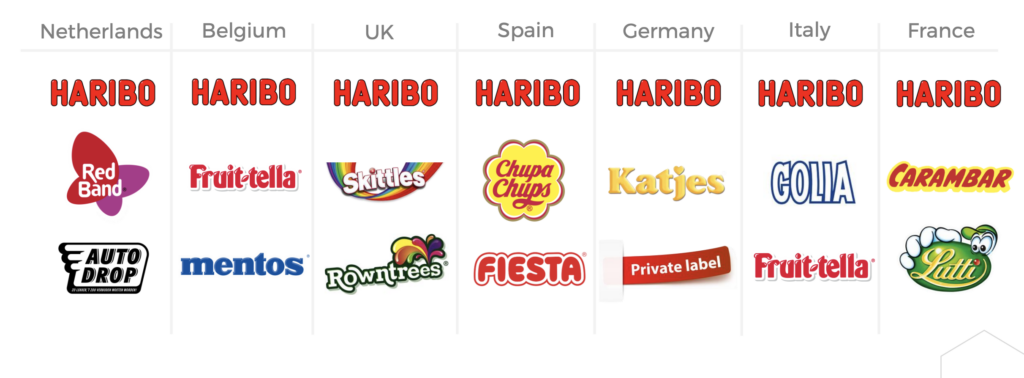

MOST POPULAR CANDY BRANDS

The findings presented in this report are based on the results of an investigative task submitted to the Roamler Crowd during the month of October 2019. The purpose was to determine the crowd’s purchasing practices when it comes to candy. The findings take into account data collected from 6.174 respondents, located in Italy, France, Spain, UK, Belgium, The Netherlands and Germany.