- Insights

The Dutch Hotel Market in Numbers: 2025

What does the Dutch hotel landscape look like in 2025? In this article, we analyze the current situation based on data from our Location Database. We examine the total number of hotels, their geographic distribution, and several characteristics of these hotels.

Overview of the market

As of May 2025, the Netherlands has a total of 2,554 hotels. This includes all types of accommodations registered as hotels, from small boutique hotels to large international chains.

The largest share of hotels (31.4%) has a room capacity of between 6 and 20 rooms. Hotels with 21 to 50 rooms make up the next largest segment, accounting for 28.1% of the market.

Where are the hotels located?

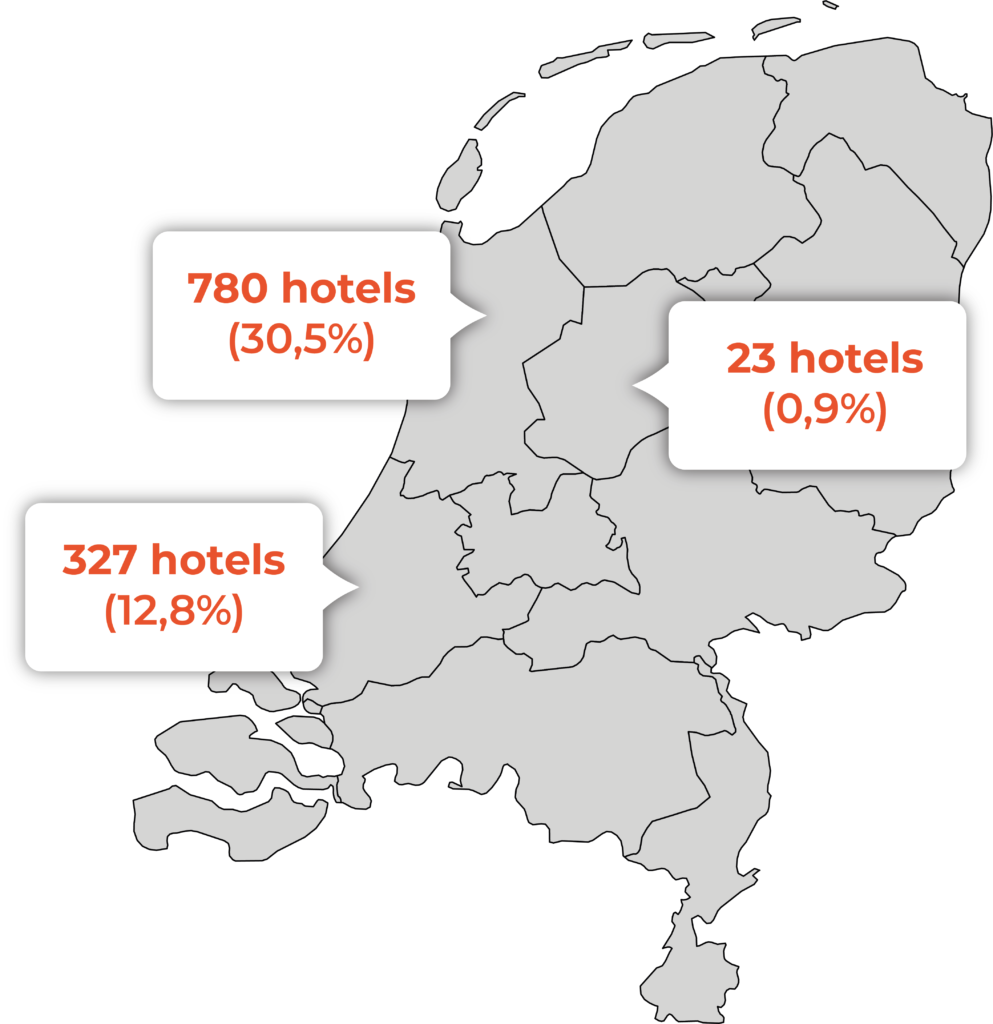

The distribution of hotels varies significantly by province.

North Holland leads with 780 hotels (30.5% of the national total), 476 of which are in Amsterdam. South Holland follows with 327 hotels (12.8%), while Flevoland has the fewest, with just 23 hotels (0.9%).

The top 5 provinces (North Holland, South Holland, Gelderland, North Brabant, and Limburg) together house 71.8% of all Dutch hotels, reflecting the concentration in both urban and tourist areas.

A look at the urban concentration

The four largest cities—Amsterdam, Rotterdam, The Hague, and Utrecht—together host 26.1% of all Dutch hotels. Amsterdam dominates with 491 locations, followed by The Hague (83), Rotterdam (70), and Utrecht (37).

Outside the major cities, we see a high concentration in tourist hotspots such as South Limburg, with Maastricht (59) and Valkenburg (49); coastal towns like The Hague (83), Zandvoort (22), and Noordwijk (21); and around the Veluwe area (71 hotels).

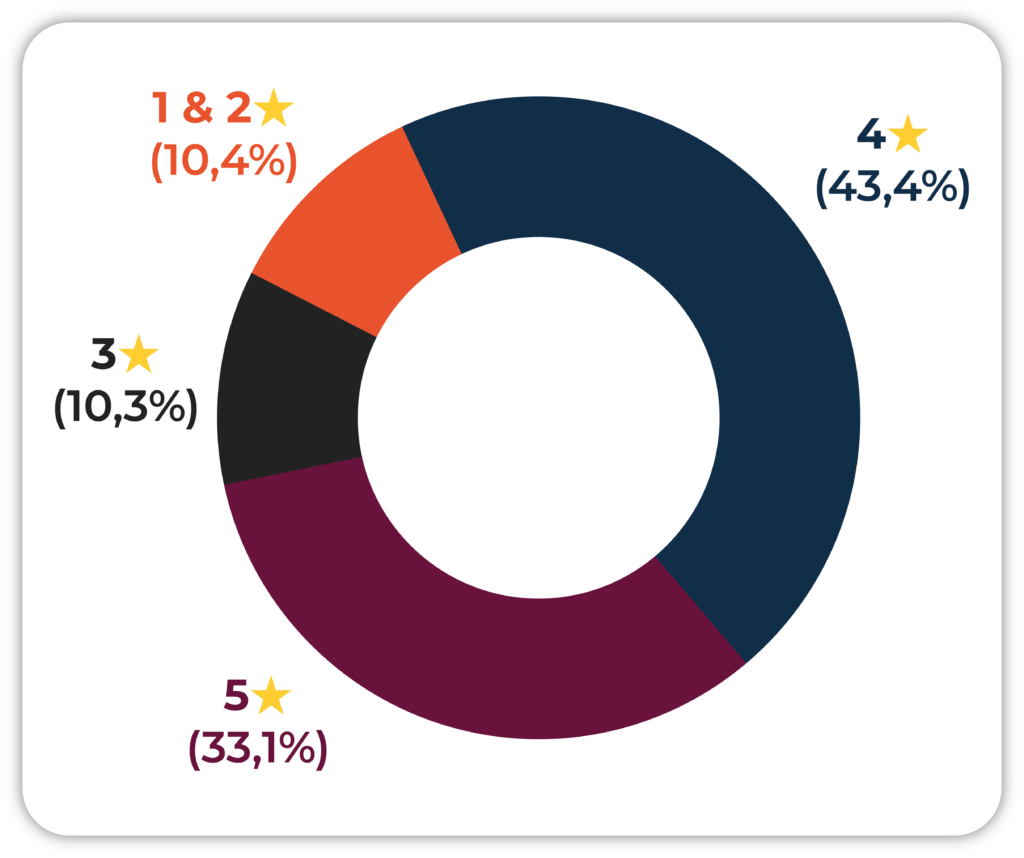

Hotel classification by star ratings

Beyond the number and location of hotels, the type of hotel is also of interest. Of all hotels in the Netherlands:

• 43.4% are in the 4-star category,

• 33.1% are 5-star,

• 10.3% are 3-star, and

• 10.4% have 1 or 2 stars.

Chains vs. Independent Hotels

Of all hotels in the Netherlands:

• 21.9% belong to a hotel chain, while

• 78.1% operate as independent hotels.

Chain hotels are mainly concentrated in and around the major cities, where 59.5% of all chain establishments are located.

The largest hotel chains in the Netherlands are Van der Valk, Best Western, and Bilderberg, together accounting for 39.5% of all chain hotels.

Conclusion

The Dutch hotel market in 2025 is characterized by strong concentration in urban areas and tourist regions. With over 2,554 hotels, the sector offers a diverse mix of accommodations.

Notable are the regional differences in hotel density and the strong position of independent hotels, which represent more than three-quarters of the market despite the presence of major international chains.

Access to up-to-date market data is crucial for businesses in the hospitality sector. With our Location Database, you can obtain essential location information, including more than 30 features, to perfectly execute your strategy.