- Insights

The Dutch Sports sector in 2025

With the (sports) summer in full swing, we thought this would be the perfect moment to explore the state of the sports sector in the Netherlands.

From football fields to padel courts, and from swimming pools to gyms: the range of sports facilities is varied and spread across the country. In this article, we dive into the data of over 13,000 sports locations.

Football remains the most popular club sport

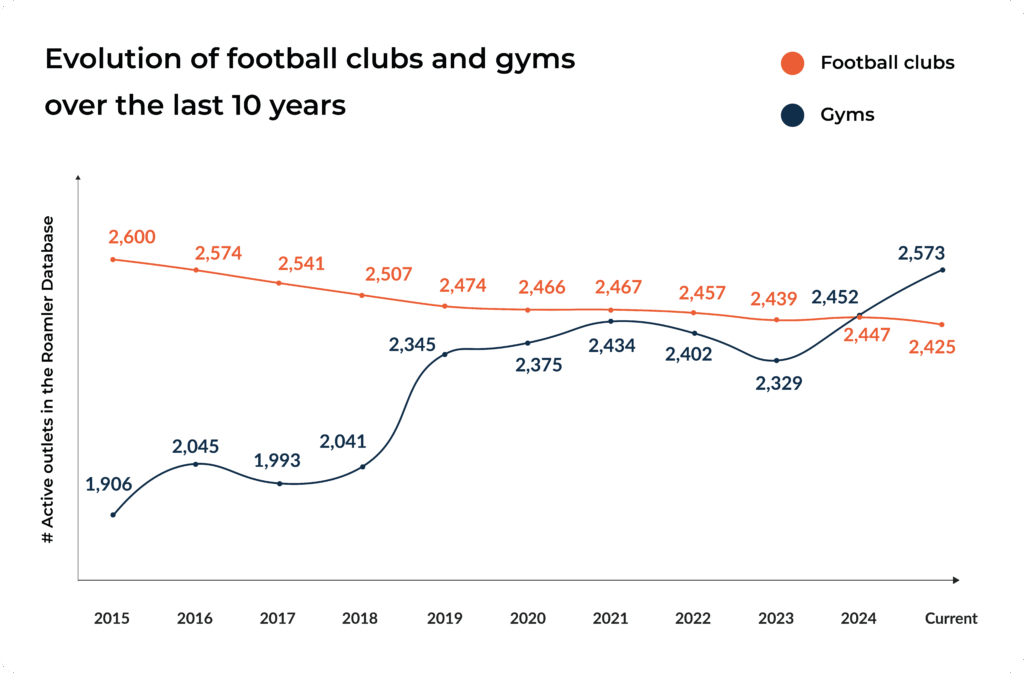

Football is still the largest sport in the Netherlands, with over 2,400 locations in 2025. However, our data shows that this number has stagnated, and the number of locations has decreased by approximately 2.5% since 2022. This decline aligns with national trends: sports participation among youth is falling, especially among boys aged 13 to 18.

(Source: NOC*NSF)

Looking further back in our data, we see that this trend has been ongoing for some time. Ten years ago, in 2015, there were still 2,600 football clubs. Since then, the number has dropped by around 7%.

Why is this happening?

Rise of Flexible and Individual Sports

A key reason is that people are increasingly choosing to exercise on their own initiative, outside of traditional sports clubs. Think of running, cycling, fitness, and bootcamps in the park.

(Source: Allesoversport)

This is also reflected in our data: gyms now account for over 2,500 locations, and this segment has shown significant growth. Although the fitness industry struggled during the COVID-19 pandemic, it has rebounded strongly, growing by approximately 10% since 2023.

Looking at the trend over the past ten years, the number of gym locations in the Netherlands has increased by 29.5%. Gyms are more popular than ever. The graph below displays these shifts:

Consequences of This Shift

Does this shift from team to individual sports affect consumption at sports venues? Are there other interesting trends to respond to? Our Market Monitor data reveals the following:

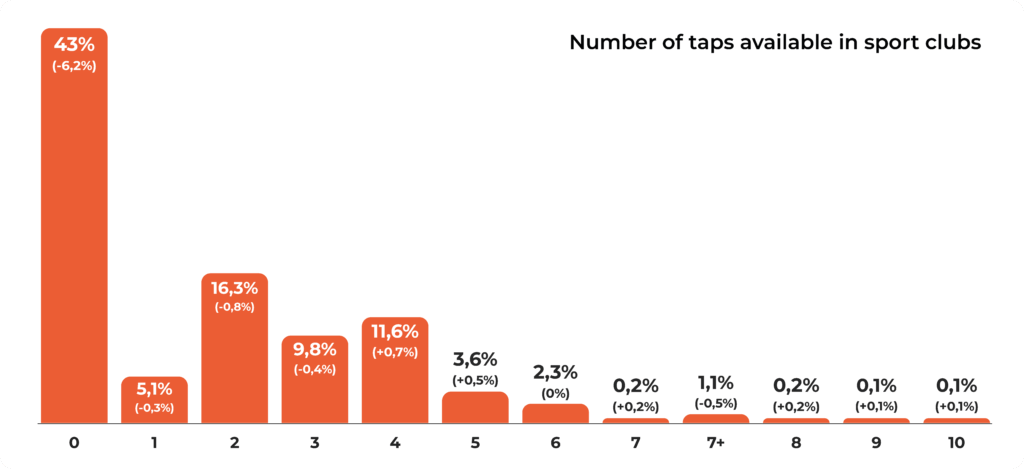

An interesting development, previously seen in the hospitality industry but now also visible in sports, is the expansion of beer offerings and the growing popularity of specialty beers. We see a decline in the number of locations without beer taps, while more locations now have 4, 5, or even 6 taps—indicating a broader beer selection.

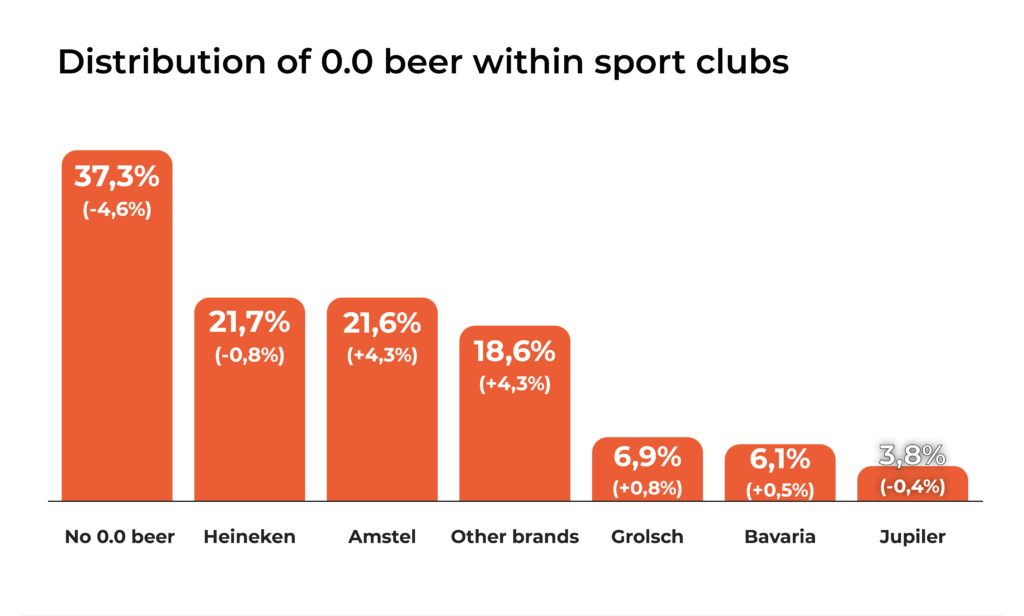

We also see an increase in the number of 0.0 beer suppliers, and a general rise in locations offering non-alcoholic beer. This is based on growth across most brands and a decline in locations where no alcohol-free beer is available.

Conclusion

The Dutch sports sector is clearly shifting from traditional team sports to more flexible and individual forms of exercise. While football remains the most popular club sport with over 2,400 locations, the number of clubs is steadily declining—partly due to reduced youth participation. Meanwhile, the number of gyms has grown by nearly 30% over the past decade, highlighting the rise of fitness and self-directed sports.

This trend also impacts consumption at sports venues. There is a clear increase in the availability of specialty and 0.0 beers, reflecting changing preferences among athletes and visitors. The sports sector is adapting not only in terms of sport offerings but also in experience and hospitality.

The data shows that sports in the Netherlands are becoming increasingly individual, flexible, and lifestyle-driven. For brands, this presents opportunities to respond to these evolving needs.